Latest data from Nielsen confirms a number of new trends being seen in the UK grocery sector since the coronavirus outbreak.

The share of all grocery sales made online reached 10% in the four weeks to 18 April as the lockdown shifted shopping habits away from multiple trips in-store. This is a rise from the 7.5% at the end of 2019, with Nielsen’s research showing that over 6.8m consumers shopped for groceries online in the last four week period, with almost one in three being new shoppers.

Meanwhile, the share of sales made at convenience stores – across all formats from independent to co-operatives and those owned by the supermarket multiples – reached a new high of 30%, with sales increasing by 9%.

Shoppers also made fewer trips across fewer retailers but they spent more, with the average spend per visit increasing by 35% during each trip.

In terms of category performance, Nielsen’s data shows that UK shoppers remained focused on purchasing ambient groceries – shelf stable goods (+17.6) and frozen foods (+13.5%), as well as beers, wines and spirits (+6.5%), all increased in sales compared to the same period last year. Sales in confectionery (-20%) and delicatessen (-21%) declined the most, the latter also being attributed to the majority of counters being closed in larger stores, as retailers redirected resources elsewhere to keep up with demand.

Beers, wines and spirits was the fastest growing category online in terms of sales – with a 78% jump. Nielsen said that this was likely due to the category being more convenient to shop online – as it’s both heavy and shoppers don’t need to personally check it over, as they would with fresh groceries.

Shoppers also purchased fewer products on promotion in the four weeks to 18 April, with the percentage of sales falling to an all-time low of 16%, down from last year’s average of 26%. This reflects the change in focus, as retailers and manufacturers place more importance on maintaining stock availability and ensuring everyone is able to purchase key supplies, following the earlier stockpiling.

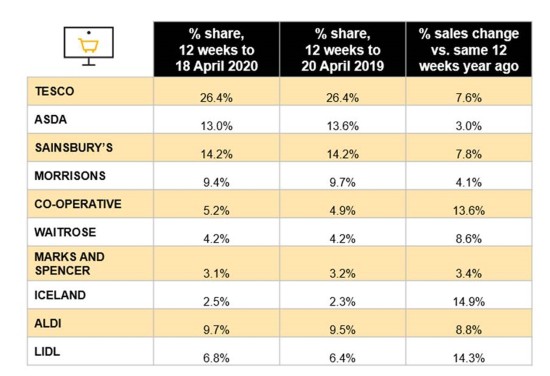

Over the last 12-week period, and due to the surge in sales pre -lockdown, all retailers experienced growth. Iceland had the biggest increase in sales, growing by 14.9% year-on-year, closely followed by Lidl (+14.3%) and The Co-op (+13.6%). Of the major supermarkets, Sainsbury’s was the fastest growing with sales up 7.8%.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, commented: “Retailers have increased online capacity significantly in the last few weeks, and they have worked quickly to adapt to the demands of shoppers amid the COVID-19 lockdown. This has been done by increasing the number of delivery slots whilst prioritising the more vulnerable and improving order sizes so that shoppers can minimise the frequency of shopping. Though this has taken away some of the footfall to stores, retailers’ impressive efficiency online in the last few weeks has relieved a lot of the pressure on store operations, which have been impacted by social distancing requirements that have limited both how we shop and what we buy.

“However, it is too soon to know whether the larger trend that we’ve seen in the last four weeks with the fall in visits and the shift to online will continue as we slowly begin to exit restricted living over the next couple of months.”

12-weekly % share of grocery market spend by retailer

and value sales % change

NAM Implications:

- No surprises here for NamNews readers.

- As always, key for NAMs is to compare their retail business with these stats…

- …by category and format…

- …to isolate and optimise opportunities.

- (unless you can think of something better?)