Total Till data from NIQ shows sales growth in UK supermarkets slowed to 4.0% in the four weeks ending 2nd November, down from a 4.7% rise in the previous month. The research firm suggested that this is likely due to shoppers holding back their spending in anticipation of Black Friday at the end of the month and the upcoming Christmas festivities.

Despite easing inflation, shoppers were still cautious with their grocery shop, with spend per visit down 6% on last year at £18.67. They also remained savvy with how they spend, with sales of items on promotion increasing from 24% to 25%. NIQ noted that 36% of branded sales came from promotions – up from 35% a year ago – with brands heavily reliant on deals to deliver volume growth.

Online sales increased 4.7% in the four-week period, boosting the channel’s market share to 12.9%, up from 12.7% the previous month.

Meanwhile, confectionery (+10.5%) was the fastest-growing category last month as shoppers stocked up on sweets for Halloween and Christmas. However, shoppers reigned in on essentials with subdued value growth in the packaged grocery category (+1.7%) and a decline in unit growth (-0.8%).

Moreover, despite an increased level of promotions, shoppers cut back on purchasing beer, wine and spirits with a unit sales decline of 0.4% – a sign that shoppers are holding back until nearer the festivities. NIQ pointed to a recent Homescan survey showing that price reductions and promotions are almost expected by consumers ahead of Christmas. The most popular are retailer vouchers with money off (24%, up from 17% last year) and product promotions (35%, up from 29% last year), which are the key factors considered by shoppers when choosing their Christmas store.

The data also shows that the cautious consumer sentiment has put pressure on general merchandise sales in supermarkets, with value down 1.4% and volumes falling 5.5%.

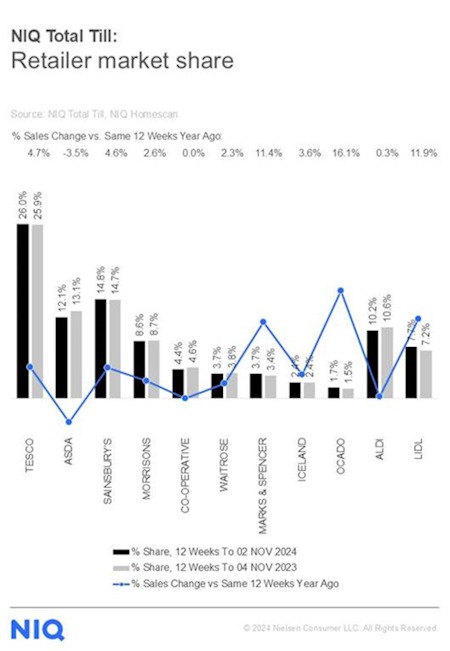

In terms of retailer performance over the last 12 weeks, the fastest-growing retailers were Ocado (+16.1%), Lidl (+11.9%) and Marks & Spencer (+11.4%). Tesco (+4.7%) and Sainsbury’s (+4.6%) also gained market share.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Total Till sales over the last four weeks have slowed, with shoppers pulling back their spend. Shoppers so far have been cautious, and it’s evident that they are saving on grocery essentials to be able to afford treats and indulgences.

“However, the start of the Christmas advertising campaigns is an opportunity for brands and retailers to entice consumers and showcase what’s new and what’s different. And given that it’s possible that many shoppers will ‘dine at home’ more in the next few weeks, we expect this to boost sales in premium private label food and drink, which NIQ expects to do very well this Christmas.”

NAM Implications:

- Standout has to be that 36% of branded sales came from promotions…

- …up from 35% a year ago…

- …with brands heavily reliant on deals to deliver volume growth.

- Also retailers are sharing the ‘persuasion burden’…

- …with retailer vouchers with money off (24%, up from 17% last year)

- …product promotions (35%, up from 29% last year).

- All signs of savvy buying by cautious consumers…

- …unwilling to accept brand premia…

- …and own-label at normal non-promoted prices.