New data released by NIQ shows total till sales at leading supermarkets in the UK grew 5.3% in the four weeks to 27th January, up from a 3.6% increase recorded in December.

With food inflation easing to 1.6%, compared to 6.4% last year, there was robust unit growth across most of the grocery multiples. However, NIQ noted that underlying growth slowed to around 3% in the New Year as consumers cut back on their spending after the costly Christmas period.

With January being a typical time of year for a health reset for many consumers, NIQ’s data showed 12% of households purchased meat-free substitutes in the period, with strong growth in freshly prepared fruit (+16%) and fresh veg accompaniments (+9%). Demand for meat, fish and poultry also increased (+9.1%) as shoppers sought to cook protein-rich meals as part of their New Year diets.

NIQ also found that half of all households now cook from scratch every day or most days, with around 16% doing so more due to the rising cost of living. This shift in behaviour has led to a spike in demand for products that elevate the dining experience, with a boost in sales of fresh gravy (+28%), fresh dough and pastry (+18%), fresh dips (+15%), and fresh cream and custard (+14%).

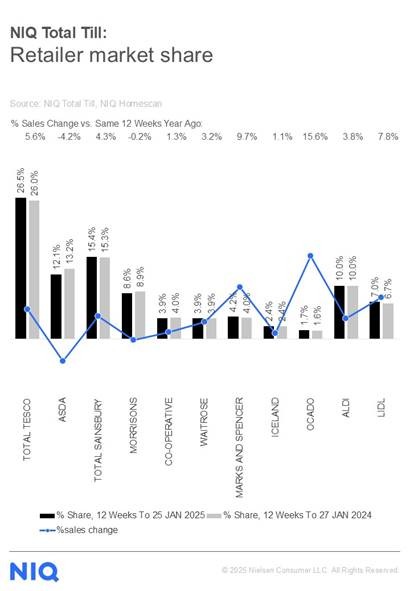

In terms of retailer performance, Ocado led with a sales growth of 15.6%. This was followed by Marks & Spencer (+9.7%) as its bigger format stores and extended range motivated shoppers to add more items to their baskets and buy its dine-at-home deals.

Asda continued its dismal run, with its sales sliding 4.2% ahead of last week’s launch of a major Price Rollback campaign aimed at kick-starting its recovery. And despite an upbeat trading statement last week, sales at Morrisons slipped 0.2%.

Tesco (+5.6%) and Sainsbury’s (+4.3%) maintained their strong momentum, while Lidl (+7.8%) and Aldi (+3.8%) both gained new shoppers and more store visits.

Mike Watkins, Head of Retailer and Business Insight at NIQ, commented: “The lift to grocery sales in the last four weeks was helped by the timing of the New Year, with a proportion of sales coming from the New Year festivities, which was the week ending 4th January (+10.0%). However, after this, weekly growth in January was slightly lower. Whilst overall Total Till sales growth was higher than December, the underlying trend is closer to +3%, which is the average growth in the most recent three weeks.”

He added: “NIQ Homescan data shows that the cost of living is still firmly consumers’ number one concern at the start of 2025. Shoppers are looking to save money and eat healthier, leading to a growing trend in scratch cooking, which is one of the key behaviours driving the strong unit growth (+2%) and value growth (+6.8%) in fresh food categories in the last four weeks.”

NAM Implications:

- Scratch cooking patently one to watch.

- Tesco, Sainsbury’s, Ocado, M&S and discounters continue to grow at the expense of Asda and Morrisons.

- Maybe it’s time for a fundamental shift in supplier trade strategies?