Data released by Nielsen shows consumer spending in the grocery sector is continuing to slow, with sales declining 1.6% in the most recent four weeks.

This is a significant drop in comparison to a bumper period last year, which saw an uplift of 5% as the supermarkets benefited from the early spring heatwave and celebrations around the royal wedding.

While sales have declined, Nielsen highlighted that there has been a slight increase in supermarket promotional activity (27% of sales), led by the promotions and price cuts celebrating Sainsbury’s and Tesco’s milestone anniversaries (150 and 100 years respectively), as have Morrisons with their Price Crunch campaign.

Supermarkets are also investing more in advertising to support these campaigns, with new data from Nielsen AdIntel revealing that advertising spend on TV and press increased by 4% year-on-year to £80.6m in the period January to April 2019 with Sainsbury’s and Tesco both launching big anniversary campaigns. However, Asda topped the list as the largest supermarket advertising spender.

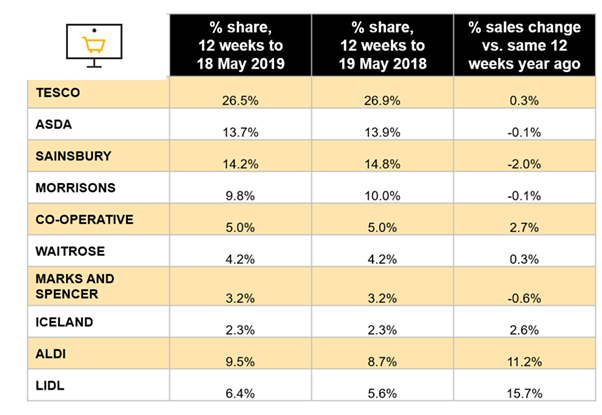

Nielsen’s data showed that over the last 12 weeks, sales fell at three out of the top four supermarkets and also at M&S, with Aldi and Lidl continuing to gain market share with double digit growth. The Co-op was the next best performing retailer, with sales up 2.7% having attracted over half a million new shoppers compared to the same time last year.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, commented: “Consumer confidence remains unchanged and with the cost of household bills continuing to rise, and 40% of households feeling insecure about their finances, the economy remains the number one concern for shoppers. The result is that shoppers remain cautious about their grocery spend as they look to manage their overall household budgets.”

He added: “However, recent advertising seems to be resonating well with the 12 million households looking to save money on grocery shopping and we anticipate that shoppers will be responding well to the price cuts and promotions associated with the milestone anniversaries at Sainsbury’s and Tesco. Yet it’s important to note that the structural shift of sales away from traditional supermarkets continues, with Aldi and Lidl still gaining combined market share. With six in 10 households visiting these two discounters every four weeks – compared to 40% just five years ago – and new store openings, they continue to grow sales fast.”

12-weekly % share of grocery market spend by retailer and value sales % change