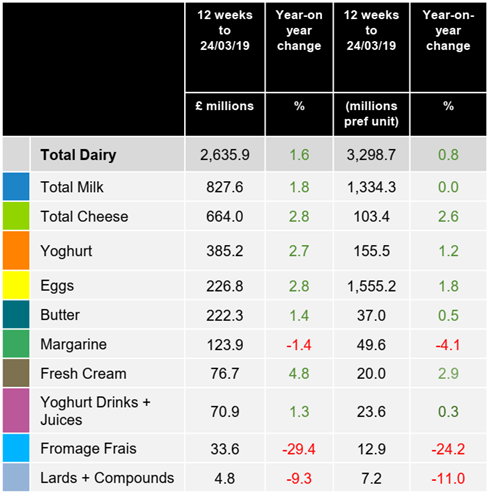

Figures from Kantar for the 12 weeks to 24 March 2019 show growth in the dairy market continuing to slow, down 0.1 percentage points to +1.6%.

This is mirrored across total grocery which grew at +1.5%, down from +2.2% last period. The fresh and chilled sector remains flat as it continues to see growth of +1.3%. From a volume perspective, grocery is down 0.1 percentage points to +1.2% while dairy has growth of 0.1 percentage points, with volume up at +0.8%.

Nishita Pattni, Client Executive for dairy at Kantar, said: “The majority of the dairy sectors are experiencing a reduction in their contribution to growth, mainly butter for which growth has slowed to £4.6m. Proportionately, eggs experienced a faster slow down, this period down by £1.5m. Cheese and yoghurt drinks stand out for their relatively stronger performance. Their contribution this period improved by £3.3m and £1.5m respectively.”

Pattni added: “The dairy slowdown is evident across most retailers, except for the discounters which see a positive uplift in their contribution by £2.3m (Lidl) and £1.9m (Aldi). Co-op and Waitrose have had a particularly challenging March as, despite being in overall growth year on year, their growth has slowed down by £3.4m and £2.1m respectively. When focusing on butter, Co-op again suffers, down by £1.2m as well as Tesco who, although relatively better at a total dairy level, have had a slowdown in butter growth by £2.3m.”

Kantar highlights that consumers in the pre-family life stage have slightly reduced dairy purchasing this quarter, as it’s decline has worsened by £4.7m. This trend is reversed for butter as the pre-family group actually see an uplift in their growth for the category, whilst older shoppers such as the retired, empty nesters and older dependents experience slowdowns of £1.2m (retired) and £1.3m (empty nesters and older dependents).

Within dairy, non-promoted sales are growing versus 2018 and growth compared to the last period this year has also seen a small increase of £600,000. However, Kantar stated that this is outweighed by temporary price reduction promotions which see a slowdown in their contributions of £3.7m and £1.5m in the latest 12 weeks. This is also seen within butter where temporary price reduction growth slows by £3.7m.