Data released today by NIQ shows total till sales at UK supermarkets rose 3.2% in the four weeks ending 28th December, a slight slowdown from the 3.7% growth recorded the previous month. However, after a subdued start to December, demand for festive food rallied in the final three weeks leading up to Christmas, with sales hitting a record £14.6bn.

This was helped by the highest level of discounts seen in three years, with 27% of all FMCG sales purchased on promotion, 37% of which was driven by brands over the four-week period. This was led by Tesco and Sainsbury’s, where promotional spending on FMCG increased to 35% and 34% respectively as they engaged shoppers with significant loyalty scheme savings.

Visits to supermarkets during the month were up 8%, resulting in-store sales increasing 3.6% year-on-year. NIQ noted that this came at the expense of online, where sales fell 1.7%, with the channel’s share falling to 11.9% from 12.5% a year ago.

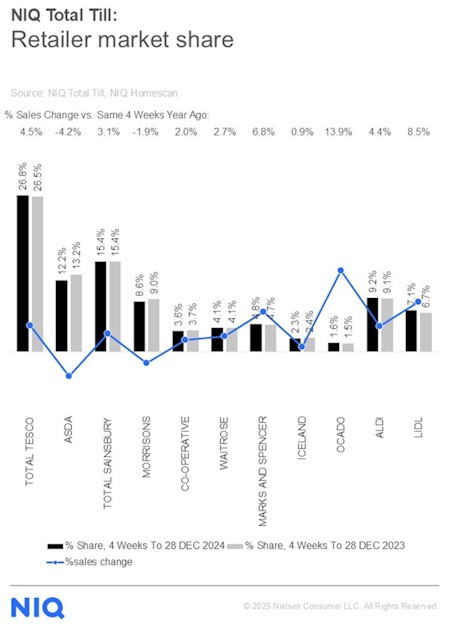

Despite the decrease in online’s share of sales, Ocado (+13.9%) was the fastest-growing retailer in December, while the discounters were the fastest-growing channel (+5.5%). Aldi and Lidl’s combined market share increased to 16.3%, up from 15.8% a year ago. In contrast, trading over the four weeks was more challenging for the convenience channel, with growth of only 2.4%.

Tesco gained market share after its sales grew 4.5% compared to a 3.1% rise at Sainsbury’s, with both retailers seeing strong increases in visits and new shoppers. Marks & Spencer’s strong momentum continued, with food sales up 6.8%, resulting in its highest-ever market share of 4.8%.

Meanwhile, NIQ category data shows shoppers purchasing items to celebrate the festive season. This included a significant boost in sales of sushi (+20%), olives and antipasti (+10%), chilled bread (+12%), nuts (+10%) and fresh and frozen fruit (+10%).

There was also strong growth across the supermarkets for fresh produce (+7.4%), bakery (+4.8%), and soft drinks (+3.6%). Sales for meat, fish and poultry also fared better than in the same period last year, with value growth of 4.4% and unit growth of 2.1%. Confectionery also did well, with 13% value growth and 5.5% unit growth. And health & beauty performed well, with growth of 6.3%.

However, sales of beers, wines and spirits fell flat, with value weakening by 1.6% and units sold falling by 1.3%. However, sales rose for stout (+13%), which may be influenced by the challenges around the draft supply of Guinness to pubs.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commented: “Overall, it was a good Christmas for most food retailers with sales growth in line with the expectations that had been set in the last three months. The topline growth was helped by the return of low inflation but also by shoppers being inclined to buy more in the final week leading up to Christmas Eve. However, shoppers still had to spend more money this year on household bills before buying Christmas indulgences and this may have taken the edge off the growth in some other categories such as alcohol and also household.”

Watkins concluded: “Looking ahead to 2025, we expect shoppers to keep managing their budgets by shopping smart and shopping around for wherever the savings are the most attractive. This means that shopping ‘little and often’ will continue with omnichannel shopping becoming an even bigger consumer trend across the industry.”

NAM Implications:

- As anticipated, consumers entered into the Christmas ‘spirit’, despite continuing caution re cost-of-living pressures.

- However, suppliers will be more interested re their fair share of relevant categories.

- Key stand-out has to be the extent to which the mults (esp Tesco & Salisbury’s) had to help sales via increased levels of promos.

- (and within total figures, the extent to which brand loyalty needed investment)

- In-store supermarket sales improved at the expense of online…

- …possibly via shoppers preferring the ‘look & feel’ of in-person shopping over Christmas…

- …meaning ‘normal’ online growth will be restored in the New Year.

- Meanwhile, some suppliers will watch M&S’s continuing progress and act accordingly…