Latest data from NielsenIQ confirms that sales in the UK’s leading supermarkets ending last year on a positive note, with growth boosted by inflation. However, weak confidence around personal finances and the squeeze on disposable incomes is expected to lead to weaker performance in 2023, with a tough start to the year as higher food prices continue to shape shopper behaviour.

Total Till value growth during the four weeks ending 31 December increased by 10.9% from 7.6% the month before. This was due to accelerated food inflation, weak comparatives and strong sales in the seven-day trading week up to Christmas Eve.

During the period, food inflation (13.3% – BRC NielsenIQ SPI) helped drive value growth. Volumes were better than in November but still fell 1.5% due to more cautious consumer spending amid the weakening economic conditions.

NielsenIQ noted that in the week to the 24 December, value sales increased by 19% at the grocery multiples and spending topped £4.6bn, marking the highest spending week on record. Volume sales also increased by 8.8%, helped by a full week of trading in the run-up to Christmas and the return of normal family gatherings after the pandemic.

For retailers, Christmas was again a highly competitive season. With further price cuts to Christmas products, NielsenIQ’s data shows promotional spend increased to 23% of all FMCG sales – the highest in 2022. Tesco increased its promotional spend using its Clubcard scheme to almost 30% – the second highest behind Waitrose at 31% – and Asda recorded 16%.

Meanwhile, with retailers pushing loyalty scheme discounts, shoppers “shopped around” with more visits to stores (7.6%) than last year.

Helped by the World Cup, beer, wines and spirits were back in growth during December, up by 0.1%. Growth was robust during the Christmas week at 11.6% as shoppers took advantage of promotions.

During the Christmas week, incremental spend at the grocery multiples was led by the desire to socialise, with strong growth in chocolate confectionery (+£32m), fresh meat and cheese (+£26m), milk (+£22m), still wine (+£20m) and crisps & snacks (+£17m). Meanwhile, with seasonal viruses on the rise, sales during December of throat care increased by 122%, cough, cold and flu remedies grew by 83%, children’s medicines were up by 63%, and facial tissues increased by 50%.

The NielsenIQ data also revealed a 2.8% growth in online sales in December. However, the channel lost share of all FMCG, falling back to 10.4% from 11.2% a year ago and 12.1% in 2020.

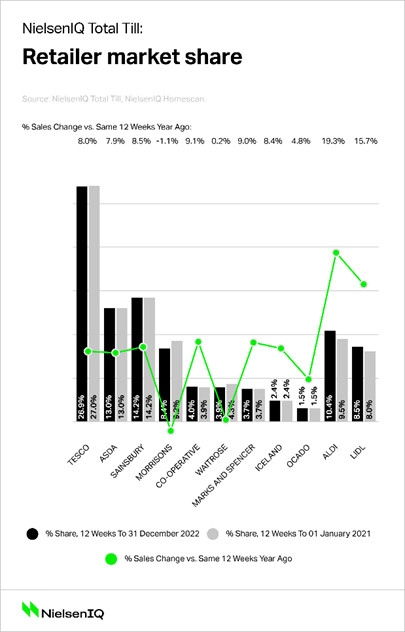

Over the longer 12-week period, Aldi was the fastest-growing retailer with a 19.3% increase in sales. Lidl was second, growing 15.7%. With over 18 million households visiting the discounters (equating for 63% of all UK households) – an additional 1.3 million on last year – new shoppers helped to drive discounter market share to 18.9% from 17.5% in 2021.

M&S and Sainsbury’s traded well over Christmas, with shoppers visiting stores more often. Tesco’s Clubcard prices helped drive its sales, whilst Asda continued to attract new shoppers with its improved offering. After seeing its sales decline during 2022, the NielsenIQ data shows Morrisons’ growth turned positive in the last four weeks of the year.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, noted that the supermarkets benefitted from the cold weather in early December and rail disruption, which impacted spending in the hospitality sector. Despite the cost of living squeeze, he said that shoppers had still been willing to buy extra Christmas indulgences. However, the overall performance of the industry was still shaped by the economic crisis and the need for consumers to save money on their grocery shopping.

Looking ahead, Watkins said: “Weak confidence around personal finances and a squeeze on disposable income will have a big impact on demand over the full year. We estimate total food retail growth in 2023 to be around 5% (a total of £190bn across all channels). However, we also expect the recession to start to influence shopper behaviour and reframe overall retail spend.”

NielsenIQ pointed to research that suggests 2023 will be even tougher for many households, with 33% only having enough money for essential spending and just 5% able to spend freely. Data from its Homescan consumer panel shows that the biggest impact on household income this year will be inflation (68%), rising domestic fuel prices (65%), and high diesel and petrol prices (51%). Even if inflation slows quickly, NielsenIQ noted that food and energy will still cost significantly more than two years ago, meaning shoppers will remain cautious.

NAM Implications:

- There we have it:

- Little, if any real volume growth in 2022…

- And recession in place for 2023.

- Obviously, a point-by-point comparison with these stats will help place your business performance in context.

- Going forward, realists will accept that a pragmatic approach to 2023…

- …means accepting that current unprecedented market conditions are the result of Lockdown.

- And any individual growth will come at the expense of rivals…

- …by defining any little relative competitive appeal…

- …and delivering more than it says on the box, every time!

- There is no realistic alternative in the New Norm.