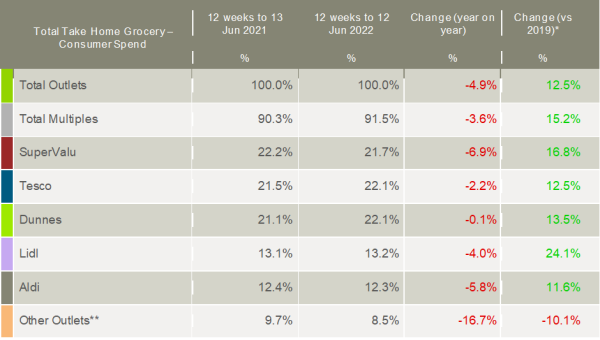

Latest data from Kantar shows that take-home grocery sales in Ireland fell by 4.9% in the 12 weeks to 12 June. While the decline is softer than last month, grocery price inflation continues to climb and hit 6.5% this period, up from 5.5% last month and the highest level in the country since February 2013.

“Food and drink prices are on a steady upwards trajectory and many people will be feeling understandably worried about the rising cost of living,” said Emer Healy, senior retail analyst at Kantar.

“Price increases are now set to add an additional €453 to our average annual grocery bill, which is over €100 higher than the figure we quoted back in early May. We’ve seen some of the sharpest increases in essentials like butter, eggs, bread, and flour, which are a non-negotiable feature on the shopping list for many of us.”

The research confirms that shoppers are taking steps to manage their spending in supermarkets, including making fewer trips to stores and switching to cheaper ranges.

Healy commented: “Unsurprisingly, 53% of the consumers we spoke to said that they will be actively seeking out any deals and discounts in store because of inflation. This is clear in the shifting balance between brands and private-label, where 66% said that they would swap the branded product in their trolley if a private-label item was cheaper. We expect this trend to continue over the next 12 months, and those retailers offering good value, own-label products and promotions will be the most successful in attracting and retaining customers.”

Dunnes and Tesco, the retailers with the strongest performance during the period, have seen €8.2m more spent between them on their own label lines. Dunnes’ consistently strong performance has now pushed into the seventh consecutive period this year. The retailer is now tied for first place with Tesco – both holding a 22.1% share of the market.

Tesco’s share grew 0.6 percentage points this period, with its performance helped by a 10% boost in online sales during June as shoppers spent an additional €2.9m.

SuperValu now holds 21.7% of the market. Lidl and Aldi follow behind, each accounting for 13.2% and 12.3%.

Meanwhile, the online grocery market grew by 9.3% in June. Healy said: “Online channels are continuing to grow even over two years on from the first lockdown, which points to its staying power as we adjust to new routines and lifestyle changes. A lot of this growth is coming from families with younger children who are getting organised as the school summer holidays fast approach. They’ve spent an additional €2.3m on online grocery shopping over June, perhaps hoping to save on extra trips out in the car and avoid the petrol pumps.”

NAM Implications:

- ‘Making fewer trips to stores and switching to cheaper ranges’

- …against a backdrop of an additional €453 to our average annual grocery bill…

- With little/no rises in income driving searches for value…

- Especially via own label.

- Making a combined discounter share of 25.2% bigger than each of the multiples.