Latest figures from Kantar show that all of Ireland’s major grocery retailers achieved growth again in the 12 weeks to 3 November 2019. On average, people visited stores 62 times in the most recent period and shopped at four separate retailers as more frequent trips helped to drive sales.

Charlotte Scott, consumer insight director at Kantar, commented: “Overall shopper frequency rose by 2.2% in the latest 12 weeks compared with last year, suggesting an increase in people shopping around for the best deals. This phenomenon is in no small part thanks to the popularity of the discount supermarkets – their comparatively smaller product ranges mean shoppers often visit them in conjunction with other stores where they top up on specific items.”

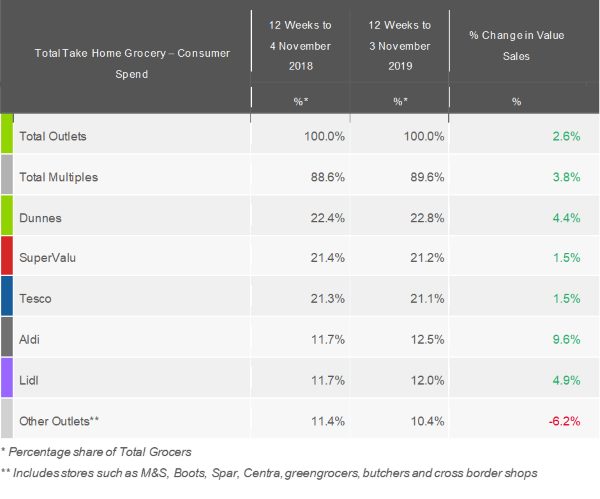

While overall market growth remained robust at 2.6%, it was marginally slower than last month’s 3.3% figure as consumers dialled back their spending ahead of the big Christmas rush.

Overall it has been a good month for Tesco, which was the only retailer to accelerate growth in the latest 12 weeks, increasing sales by 1.5%. However, it remained the third-largest supermarket in Ireland with a 21.1% share of the market, having lost its number two spot to SuperValu (21.2%) last month. Both retailers performed well over Halloween, recording an additional €6m of confectionery sales collectively.

Dunnes’ growth of 4.4% was again the fastest among the three biggest retailers. Ireland’s largest supermarket also increased its market share by 0.4 percentage points, bringing it to 22.8%. Dunnes is likely to see further growth over what is traditionally its strongest time of the year. Scott said: “Typically Dunnes performs well during the festive season as shoppers trade up and are willing to spend more on premium items. Last Christmas the retailer recorded its highest market share since March 2013 and having been top of the retailer rankings for over a year now, it will be looking to break that record this December.”

Meanwhile, Aldi and Lidl delivered the fastest growth in the market this period, with their sales increasing by 9.6% and 4.9% respectively. Shoppers visiting stores more often in the latest 12 weeks was key for both retailers, as new offers tempted people through their doors. Scott commented: “Aldi has placed increased focus on brands in recent months, and as a result branded sales have increased by 34.2%. These items now make up 10.8% of spend at the grocer, compared with just 8.8% this time last year.

“Lidl meanwhile has looked to capitalise on the growing popularity of meat-free alternatives by introducing vegan burgers and sausages to stores across the country. It’s no wonder the retailer sees potential in this market, some 40.4% of shoppers bought a vegetarian product in the latest 12 weeks, while meat-free burgers and grills have grown by 7.7% year on year.”

Kantar’s data shows that grocery market inflation in Ireland now stands at 1.2%.