Latest data from Kantar shows take-home grocery sales in Ireland increased by 6.6% over the four weeks to 7 July, driven by price inflation and spending on food and drink during the Euros.

Grocery inflation in the market now stands at 2.6%, a small increase of 0.14 ppts over last month, but the first time that the figure has risen after a consistent 15-month decline.

Emer Healy, Business Development Director, Kantar, commented: “Although there has been a slight increase in inflation, it’s still the lowest level we’ve seen since March 2022 and down 11.8 ppts compared to July 2023.

“It means that shoppers in Ireland remain on the lookout for value deals in the market, with over 25% of value sales on promotion. With retailers keen to push their own label products, we’ve seen strong sales this period with shoppers spending an additional €67.8m year-on-year and total market growth of 4.5% on these ranges.”

Kantar noted that premium own-label ranges performed well, with shoppers spending an additional €15.5m – a 10.8% increase compared to this time last year. Brands also grew ahead of the total market in the latest 12 weeks, up 6%, with shoppers spending an additional €86.3m on branded products versus last year.

The data confirms that the colder weather this year has meant that people are not spending as much on the usual barbecue and summer fare. In the last four weeks, shoppers spent a combined €800k less on chilled salads, burgers, grills and steaks than last year. Instead, they turned to soups and hot beverages, with a combined €1.8m more spent on these items compared to last year.

Meanwhile, online sales rose 12.1%, with shoppers spending an additional €19.2m in the channel. An increase in volume per trip, alongside recruiting new shoppers, contributed a combined €12.5m to overall growth.

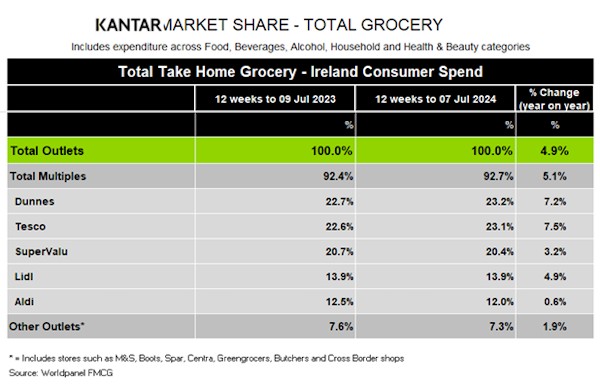

Looking at the performance of individual retailers, Dunnes’ market share increased to 23.2% after seeing spending growth of 7.2% year-on-year. Its growth stems mainly from more frequent trips and larger trips, which contributed a combined €42.7m to its overall performance.

Tesco held 23.1% of the market after delivering the highest growth at 7.5%. It had the strongest trip frequency growth amongst all retailers for another consecutive month, up 6.7%, contributing an additional €46.4m to its overall performance.

SuperValu held 20.4% of the market with growth of 3.2%. Its shoppers made the most trips in-store when compared to all retailers, an average of 21.6 trips. The retailer also saw the strongest growth in volume per trip amongst all retailers, up 5.1%, while welcoming new shoppers into stores, which contributed a combined additional €50.2m to overall performance.

Lidl held a 13.9% share after growth of 4.9%. More frequent trips contributed an additional €36.8m to the discounter’s overall performance. Aldi’s share slipped again to 12% after growth of just 0.6%. However, more frequent trips and new shopper arrivals contributed an additional €11.6m to its overall performance.

NAM Implications:

- Own-label growth of 10.8% vs brands growth of 6% stands out.

- And given that own label ‘tryers’ may find the experience better than anticipated…

- …means brands may need to pay in order to win back former loyals.

- (perhaps a case for Retail Media?)

- Meanwhile, online sales up 12.1% puts extra pressure on bricks & mortar profitability.

- Finally, a Lidl-Aldi battle for discounter share in the offing?