The latest figures from Kantar suggest Irish consumers are cautiously returning to pre-Covid habits. Grocery sales growth over the four weeks to 12 July slowed to 17.8% from 25% the month before as shoppers started to spend less on food for their fridge and more on eating and drinking out. But while some trends are reversing, it appears that others are here to stay for the longer term, with some local brands still benefitting.

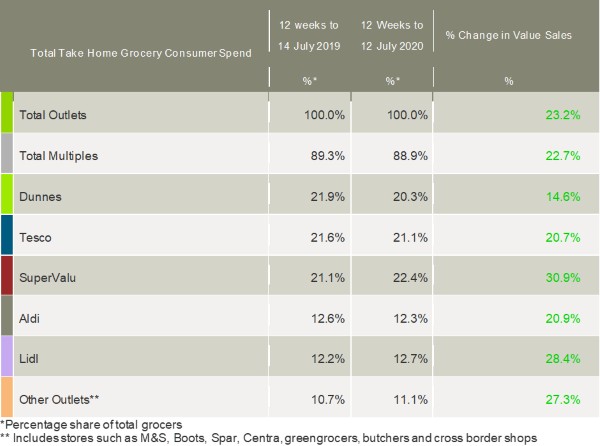

Over the longer 12-week period, take-home grocery sales in Ireland increased by 23.2%. Three months of increased spending meant an additional €577.7m passed through tills while people continued to work from home, and pubs, bars and restaurants remained closed until the end of June.

While shoppers began to return to pre-lockdown behaviour as restrictions were eased and non-essential retail was reopened, some habits remained. Emer Healy, retail analyst at Kantar, said: “Shoppers are continuing to treat themselves at home, with sales of savoury snacks and confectionery up 45% and 35% respectively in the most recent 12 weeks. In an uncertain time, people looked to tried and trusted favourites to provide their stay-at-home comforts.

“Brands outpaced own label alternatives and an additional €345m was spent on household names in the latest three months. Homegrown Irish brands like Barry’s Tea, Keelings, Kelkin and Keogh’s all experienced a sales boost as shoppers turned to much-loved classics.”

Aldi was the major beneficiary of the run on branded goods. Its branded sales increased by more than half which helped the retailer to grow by 20.9% year on year. It was also a record breaking few months for Lidl, which celebrated its 20th anniversary in Ireland over the latest period and marked the occasion by recording its highest ever market share of 12.7%.

Elsewhere there was further evidence to suggest that lockdown habits will stand the test of time. Grocery sales through digital platforms soared by 123% year-on-year as the pandemic continued to encourage demand for online shopping. Healy commented: “It goes without saying that lockdown had a major role to play in driving more shoppers to try online grocery shopping, and it looks like the boom is set to continue. An additional 75,000 shoppers purchased groceries online over the past 12 weeks, contributing €38.9m to the channel.”

People continuing to spend more time at home also meant sales of alcohol in supermarkets grew by 76% in the latest twelve-week period. Healy said: “Although people are free to visit pubs and restaurants with the easing of restrictions in recent weeks, limitations on group size and time allowed at the table are potentially contributing to the continued boost in take home alcohol sales. And with many of us attending fewer social gatherings, as well as continuing to work from home, deodorant sales are also down 15% compared with the same time last year.”

Among the traditional big three supermarket retailers in Ireland, SuperValu claimed the biggest market share for the fourth month in a row and saw sales rise by 30.9% as it remained the only major grocer not to experience reduced footfall in the latest 12 weeks. Tesco’s typically larger stores allowed it to capitalise on bigger trolley shops and it grew by 20.7% to hold a 21.1% share of the market.

Building on its traditional strengths, Dunnes recorded the highest spend per buyer of all the grocers as shoppers parted with an additional €12.24 per trip on average and continued to increase their trip sizes. The retailer recorded growth of 14.6% this period.

NAM Implications:

- Key for suppliers to check how their sales compared by retailer, category and geography, vs these stats.

- And with combined Aldi & Lidl share of sales being 25% vs mults…

- …can you afford not to be onboard the discounters?