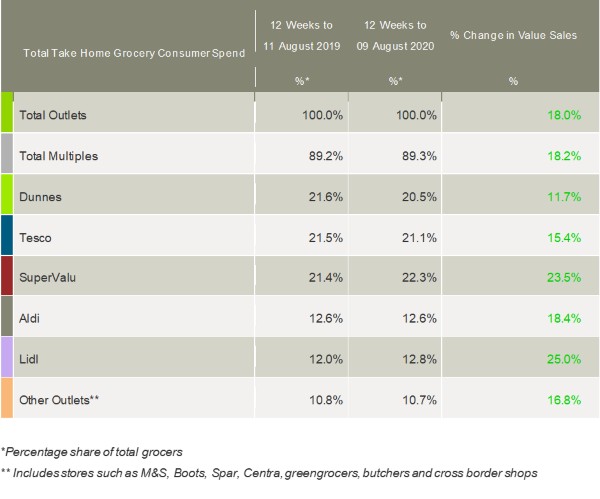

Latest figures from Kantar show that take-home grocery sales growth in Ireland slowed to 18.0% year-on-year during the 12 weeks to 9 August. While still significantly higher than pre-pandemic levels, grocery spend of €930m over the latest four weeks was the lowest since February as the country eased out of lockdown.

Emer Healy, retail analyst at Kantar, commented: “With restrictions on movement and eating out lifting, grocery spend is climbing down from the record-breaking heights we saw in previous months. A year-on-year comparison shows that shoppers still visited stores four fewer times over the 12 weeks, but trends are less stark than they were at the peak of lockdown.

“The relaxing of rules across much of Ireland means shoppers are less inclined to favour large, infrequent shops. People spent approximately €5 less per trip over the past four weeks compared with April, picking up fewer items in store as they start to return to pre-Covid-19 habits.”

However, as with other markets around the world, online sales in Ireland continued to accelerate. A growth rate of over 125% drove the channel to a record market share of 4.6% of total sales this period, contributing an additional €75.1m to the market.

Online wasn’t the only stand-out performer with the economic uncertainty and predictions of recession failing to dampen consumer demand for branded groceries. Healy said: “Brands have managed to capture an impressive proportion of consumer spend over the latest period, amounting to an additional €245m and outpacing private label to grow by 23.4%. It suggests that people are choosing to treat themselves in store with little luxuries while we’re all spending more time at home.”

Aldi and Lidl both saw branded sales soar, but the two retailers’ reputation for value means they also stand to benefit should shoppers look to tighten their belts. Aldi recorded strong growth of 18.4% over the latest period. Meanwhile, Lidl, which recently launched its Plus rewards scheme in the country, achieved the strongest growth rate of all the major retailers, helping it to its highest ever market share of 12.8%.

All of Ireland’s traditional retailers registered growth over the period. Buoyed by their online offers, SuperValu continued to hold the highest market share at 22.3% and Tesco took second place at 21.1%. SuperValu remained the only retailer to attract new shoppers this period, contributing an additional €624,000 to its growth. Bigger baskets, with volumes up 25%, and higher average prices drove growth for Tesco this month.

It was a similar story for Dunnes with the retailer again recording the highest average spend per trip while also experiencing an increase in volumes and higher average prices to hold a 20.5% market share.

Meanwhile, Kantar’s data showed that grocery inflation in Ireland stood at 2.2% for the 12-week period.

NAM Implications:

- If Online, Brands And Discounters are still prospering…

- …at the expense of traditional Bricks & Mortar retail…

- …in a flatline market…

- …it follows that traditional Bricks & Mortar retail market shares will fall.

- Don’t expect them to sit on the sidelines.