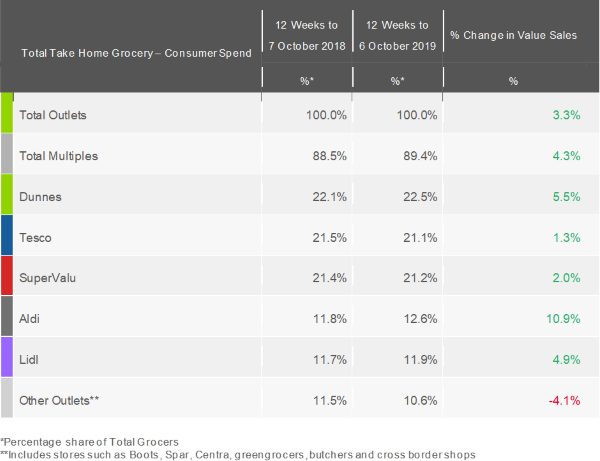

Latest figures from Kantar show growth in the Irish grocery market accelerated to 3.3% in the 12 weeks to 6 October despite the looming Brexit deadline.

The researcher found little sign of concern amongst shoppers about the UK’s potentially disruptive exit from the EU with many visiting supermarkets more often and making larger trips this period than they did last year.

This time 12 months ago Dunnes overtook Tesco to become Ireland’s number one grocer, and it is showing no signs of slowing down. The retailer currently holds a 1.3 percentage point lead over its next largest competitor, the biggest differential it has enjoyed since February 2019. Charlotte Scott, consumer insight director at Kantar, commented: “It has been a big year for Dunnes. Its continued success, evidenced by 5.5% sales growth in the past 12 weeks, has largely been driven by its Shop & Save voucher campaign.”

SuperValu also enjoyed a marked boost in sales over the past 12 weeks, doubling its growth rate to 2.0%, which helped it to overtake Tesco and become the second largest retailer in Ireland for the first time since December 2018. The chain is said to enjoyed larger basket sizes and growth in some of its core categories.

Scott explained: “Ireland’s two largest retailers, Dunnes and SuperValu, have both benefited from an out of season boom in sales of cleaning products. Shoppers have been indulging in a spot of seasonal ‘autumn cleaning’, perhaps thanks to the popularity of internet sensation Mrs Hinch and being kept indoors by the recent wet weather. Overall people have spent an additional €7.2m on household cleaning in the past 12 weeks, which is up 5.9% on last year and driven by Ireland’s two largest retailers.”

Despite falling behind SuperValu in the retailer rankings, Tesco enjoyed a return to growth this period, with shoppers making an extra trip compared to last year. Confectionery has been a key category for Tesco, and is growing at 31.1%. Scott said: “Tesco individually accounts for 70% of the market growth of confectionery, which has increased in value by 9.9% in the past 12 weeks. The retailer’s promotion on tubs of sweets, pricing them at €3.99, has proved particularly popular and it has even had to put quotas in place to limit shoppers to a maximum of 4 per person. With Halloween and Christmas just around the corner, Tesco will be particularly encouraged by these results.”

Meanwhile, Aldi reached a new record market share at 12.6% after growing sales by 10.9%. It welcomed an additional 21,000 shoppers through its doors, with a particular push to target young families.

Lidl’s overall performance also improved, with sales up 4.9% and its market share increasing to 11.9%. However, while the discounter’s existing shoppers are visiting more often, and spending more when they do, Kantar found that penetration has dropped slightly by 0.4%.

NAM Implications:

- Have to keep in mind the origins of the new man in Tesco…

- …and the extent to which he will have time to deal with any share of market issues at ROI local level…