Latest data from Kantar shows take-home grocery sales in Ireland rose by 10.8% in the four weeks to 11 June as the average price per pack increased 14.1%.

While value sales were up during the period, grocery price inflation remains the main driver. Kantar’s overall grocery inflation measure rose by 15.8% in the 12 weeks to 11 June, which is down on last month’s level of 16.5% and is the lowest inflation rate in Ireland so far this year.

Emer Healy, Senior Retail Analyst at Kantar, commented: “This latest drop in grocery price inflation will be very welcome news for consumers, although it is too soon to say if this is the ceiling as inflation rates are still much higher than we have previously seen”.

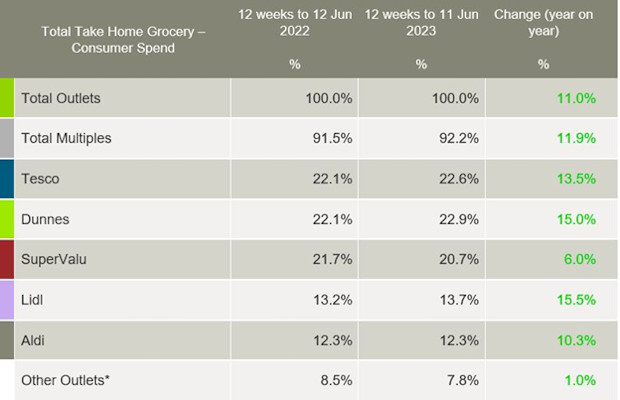

Over the 12-week period, take-home grocery sales increased by 11%, with consumers turning to shopping little and often to help manage household budgets. Shoppers made an average of two additional trips compared to last year.

Meanwhile, the percentage of packs sold on promotion increased to 25.8% compared to 24.7% last year, showing shoppers are carefully choosing promotional items to help them to make ends meet.

With the cost-of-living crisis bringing change to traditional shopping and eating behaviours, people also appear to be thinking more about what they eat and how they cook at home. As shoppers look for easier meals with less waste, sales of total chilled ready meals climbed 20%, with shoppers spending an additional €2.9m year-on-year.

The growth in sales of own-label (15%) was almost double that of brands (7.8%) as shoppers look for ways to save money. Value own label saw the strongest growth, up 28.9% year-on-year, with shoppers spending €15.7m more on these ranges.

Online sales remained strong, up 2.2%, with shoppers spending an additional €3.5m in the channel year-on-year. New shoppers boosted overall growth by €6m as nearly 17% of Irish households purchased online.

Dunnes, Tesco and Lidl all grew sales ahead of the total market in terms of value this month, with the gap in market share beginning to close between the top two retailers.

Dunnes continued to hold the highest share amongst all retailers at 22.9%, with growth of 15% year-on-year. This growth stemmed from shoppers returning to store more often, up 2.1% year-on-year, along with new shopper arrivals up 3.3ppts year-on-year.

Tesco holds 22.6% of the market with 13.5% growth year-on-year. It has the strongest frequency growth amongst all retailers, up 17.7% year-on-year, contributing an additional €103.6m to its overall performance.

SuperValu held 20.7% of the market with growth of 6%. Its shoppers made the most trips in-store compared to all retailers, an average of 24 trips, up 15.3% year-on-year.

Lidl hit a record new share of 13.7%, with growth of 15.5% year-on-year. More frequent trips and new shoppers contributed an additional €45.2m to the retailer’s overall performance. Aldi held 12.3% of the market, with growth of 10.3% year-on-year. A boost in new shoppers and more frequent trips contributed an additional €49m to overall performance.

NAM Implications:

- i.e. shopping around for value.

- Consumers are not only savvy in terms of what they pay….

- …but also careful about ‘what they eat and how they cook at home’.

- This will all make for even more careful buying habits as consumers settle into the New Norm.

- Meanwhile, Lidl and Aldi, with a 26% combined share of grocery take-home, must be a cause of concern for mults…