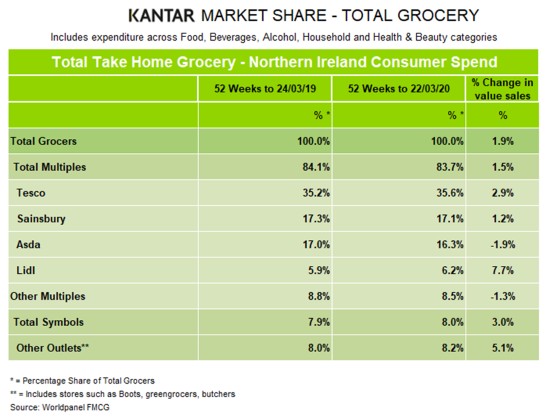

Latest figures from Kantar show the Northern Irish grocery market has also felt the effect of the coronavirus pandemic. Overall sales growth of 1.9% during the 52 weeks to 22 March 2020 is markedly higher than the 0.1% seen last month, showing how the outbreak has altered shopper behaviour.

David Berry, Kantar’s Managing Director for Ireland at Kantar, said: “While growth over the 52 week ending period may sound relatively modest, the true impact can be seen when looking at a shorter, 12-week ending time frame. Sales over the 12-week period grew by 8.3% compared with the same time last year, as shoppers spent more than £800m on groceries. This represents the second-highest 12-week sales number on record, and an increase of more than £60m year-on-year.

“Shoppers have understandably been keen to make sure they have good supplies of hygiene and cleaning products as they prepare to spend more time indoors. Sales of hand soap rose by 60% over the past 12 weeks while facial tissues and toilet roll grew by 37% and 30% respectively. Household cleaners were also up by almost a third as people sought to temper the spread of the virus and maybe to fit in some spring cleaning as well.”

Commenting on individual retailer performances, Berry said: “Tesco, Northern Ireland’s largest retailer, enjoyed the greatest increase in market share, up by 0.4 percentage points to 35.6%. Meanwhile, Lidl posted the strongest increase in sales, with shoppers spending 7.7% more in store, caused by more frequent trips and slightly higher prices.

“Sainsbury’s moved further ahead of Asda in terms of its market share. The former now accounts for 17.1% of the market while the latter slipped to 16.3%, as the value of Asda’s sales fell by 1.9% year on year.”

Separate data released by Kantar yesterday for the Republic of Ireland showed the grocery market experienced its busiest ever period over the 12 weeks to 22 March 2020 – increasing year-on-year sales by 10.1%.

NAM Implications:

- Tesco to be expected.

- Focus instead on Lidl’s 7.7%…

- …and ask yourself the obvious.

- Hint, can you really afford to be outside the Lidl-loop, anywhere?