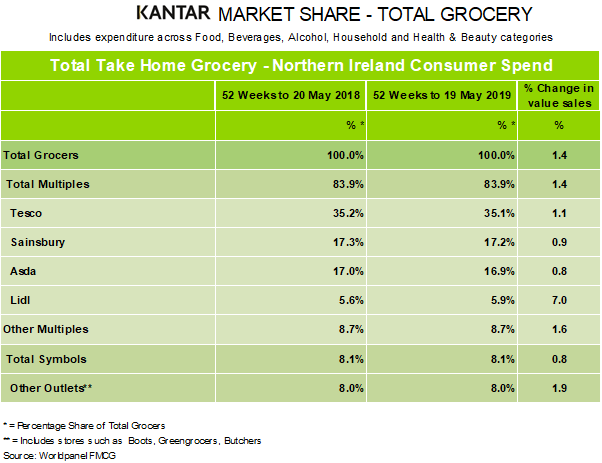

Latest data from Kantar shows that grocery sales in Northern Ireland grew by 1.4% over the 52 weeks to 19 May 2019, with higher prices offsetting a 0.1% decline in volumes.

Commenting on individual retailer performances, Douglas Faughnan, consumer insight director at Kantar, said: “Northern Ireland’s three largest retailers, Tesco, Sainsbury’s and Asda all saw their market share eroded by 0.1 percentage points, with Lidl the primary benefactor as it continues to perform strongly both north and south of the border. The retailer now accounts for 5.9% of the market in the north, marginally higher than the 5.8% share it holds in Britain, but still some way off the 11.5% it claims in the Republic of Ireland.”

Faughnan added: “Last month’s decision by the Competition and Markets Authority (CMA) to block the proposed Sainsbury’s and Asda merger means Tesco’s position as the number one retailer looks safe for the near future. It now accounts for 35.1% of sales compared to Sainsbury’s and Asda’s market shares of 17.2% and 16.9% respectively.

“The proposed merger would have seen more than £2 in every £3 spent on grocery in Northern Ireland be shared between two retailers. According to the CMA, this would mean reduced competition and increased prices for the consumer – in a region where prices are already on the rise, up 1.5% in the past year. With the merger now dead, the focus for all three major retailers in the North will return to preventing further losses to Lidl, which continues to grow at an impressive 7%.”

Similar data released yesterday for the grocery market in the Republic of Ireland showed Dunnes Stores holding off the challenge of Tesco and retaining pole position, whilst the discounters continued to make strong progress.