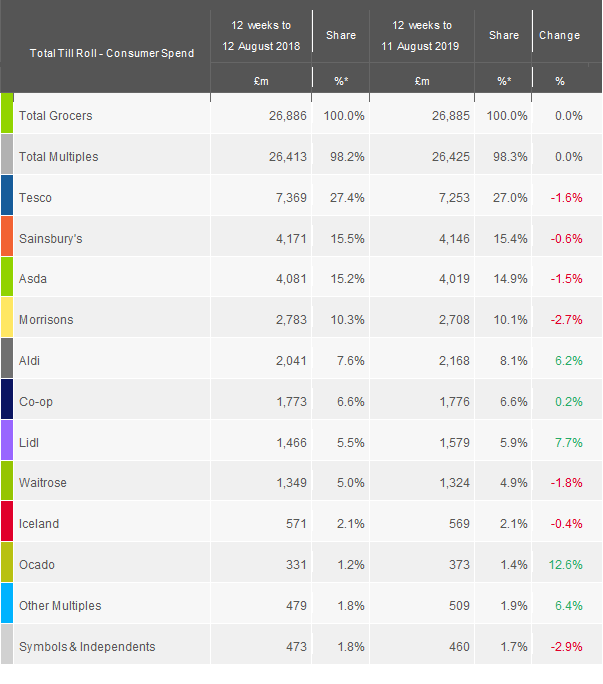

Lidl has reached a new record in terms of UK grocery market share, helped by strong sales in the 12 weeks to 11 August 2019. However, overall supermarket sales were flat year-on-year during the period, according to the latest figures from Kantar, due to continued tough comparisons with 2018’s strong summer.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “The memory of last year still looms large for retailers and this summer’s comparatively poor weather, combined with low levels of like-for-like price rises, have made growth hard to find for retailers.”

During the period, Lidl’s sales increased by 7.7% and the discounter reached a market share of 5.9%, with its new store openings helping it attract 489,000 additional shoppers. Kantar said the discounter’s campaign to encourage people to do their main weekly shop at Lidl is making an impact, with the average basket spend now nearly £19 (+3% from last year), though still significantly lower than the £22.65 average spend at the big four. Additionally, branded lines at Lidl grew by 19% this period and now account for 13% of the discounter’s sales with a strong presence for alcohol, toiletries, household products and soft drinks.

Meanwhile, sales at Aldi increased by 6.2%, supported by sales of bakery products (+11%) and biscuits (+13%). McKevitt commented: “Nearly half of all households shopped in an Aldi during the past 12 weeks, showing the extent to which the discounter has established itself in our retail landscape – this figure increases even further to 58.4% in the north of England where the retailer is most popular.”

Ocado took the top spot as the UK’s fastest growing grocer, with sales up 12.6% in this period, helped by a 7% increase in its shopper base and a £1.93 increase in spend per delivery.

In a tough market, Co-op also found growth with its sales edging up 0.2% year-on-year. Its new high-profile £3.50 burger and beer deal, which encourages shoppers to opt for barbecue favourites despite the weather, helped bring customers into its stores more often. Meanwhile, sales of its premium Irresistible range grew by 11% driven by strong performances for crisps and snacks, cheese and fruit.

Sainsbury’s accounted for 15.4% of supermarket sales this period. McKevitt noted: “While each of the Big Four lost share, Sainsbury’s will be cheered to be the strongest performer among this cohort for the first time since November 2017. Bucking the market-wide own label trend, sales of branded goods at Sainsbury’s rose by 1.5%, driven by higher levels of promotion and its price lockdown strategy.”

Asda and Tesco’s sales shrunk by 1.5% and 1.6%, respectively, although McKevitt pointed out: “It wasn’t all bad news for Asda and Tesco this period. Asda’s online growth of 11% was notably strong while Tesco continues to find success with its cheapest own label lines. In fact, total sales of Tesco’s value tier were £29m higher than this time last year.”

Already selling more items through deals than any other retailer, Morrisons increased its level of promotion this period as its overall sales fell by 2.7%. A reduction in number of items bought per trip also contributed to this decline and its market share fell to 10.1% during the past 12 weeks.

Waitrose’s market share decreased by 10bps to 4.9%, with the chain selling 8% more free-from products than this time last year. McKevitt noted: As diets change and public awareness of food intolerances continue to grow, free from products account for a greater proportion of sales at Waitrose than at any other retailer.”

And finally, Iceland’s market share held steady at 2.1%, with sales down by 0.4% during the past 12 weeks.

NAM Implications:

- Need any more encouragement to find a place on Lidl’s shelves…

- Somehow?