New data released by NIQ shows that sales at the leading UK grocery multiples rose 4.3% to £4.8bn during the week ending 23 December, with volumes turning positive (+1.2%) as shoppers traded up on festive products and promotions hit a four-year high.

Over the full four weeks to the 30 December, shoppers spent £657m more on groceries after a year of significant price rises across most categories. Total till sales over the month were up 6.6%, slightly down on the 6.8% growth recorded in November but in line with the slowdown in food inflation. As expected, the discounters continued to grow, but Marks & Spencer was the winner amongst the traditional supermarkets.

After a year of surging inflation, NIQ noted that shoppers focussed on essentials and economised on discretionary spend, such as general merchandise, to afford to trade up in food and drink. Affordable treats proved popular, including crackers and savoury biscuits (+15%), ice cream (+15%), pickles (+15%) and olives and antipasti (+15%). There was also growth in crisps and snacks (+6.3%) and soft drinks (+7.4%).

However, despite the festive season usually being a time to entertain and celebrate, sales of beers, wines and spirits (BWS) were disappointing, and it was one area where shoppers bought less. This included Champagne (value sales -5.8%), port (-4.3%), sparkling wine (-2.7%) and spirits (-2.0%).

Promotions increased to 26.5% of FMCG sales, which is a four-year high. NIQ noted that this was due to competition between retailers remaining intense with price cuts and extended loyalty scheme discounts on seasonal items.

Across all of FMCG, own-label growth in December remained strong at 7.7% and ahead of brands (+3.9%), with retailers highlighting the quality as well as the value of their own product ranges.

Over the four-week period, NIQ found that online sales (+7.7%) were just ahead of bricks & mortar stores (+5.5%), with 27% of households shopping online. This was a similar figure (27.6%) to Christmas 2022, but for context, significantly up on the 18% recorded in 2017, which was the last time Christmas Eve was on a Sunday. Overall, online’s share of FMCG spend was 10.6%, a small increase on the 10.4% recorded over the same period last year.

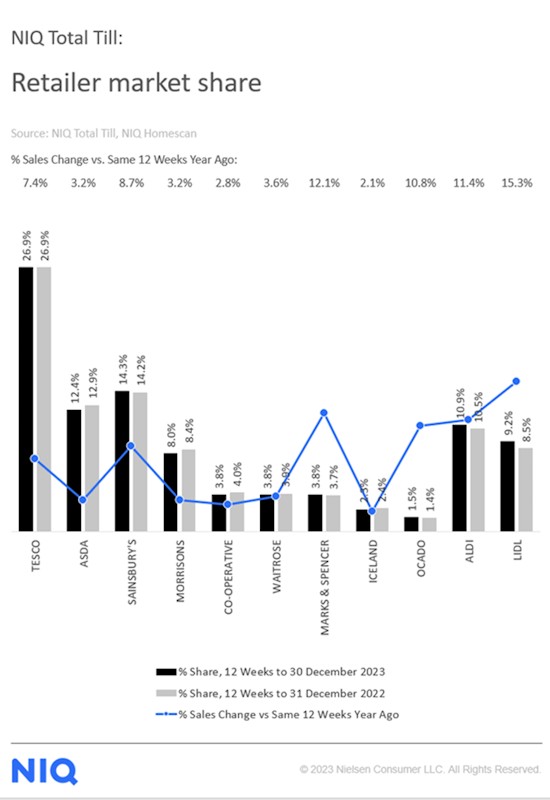

NIQ’s data confirms shows that the discounters continued to be the fastest-growing channel overall. Both Aldi (+11.4%) and Lidl (+15.3%) continued to outperform the market, with their combined market share increasing to 20.1%, compared to 19% in same quarter the previous year.

However, with some shoppers still seeking to trade up for Christmas, M&S was the best performer amongst the traditional supermarkets, with its sales growing 12.1%. NIQ found that almost 29% of households shopped at M&S in December – up from 27% in the same period last year and equal to 500,000 new shoppers. The strong performance was also achieved against tough comparatives of 12% growth in the same period last year.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commented: “With a full week of shopping before Christmas day and then the benefit of another week to spend in the build up to New Years Eve, it was an omnichannel Christmas. Shoppers mixed and matched across the month to take advantage of the convenience of an early online delivery or click & collect, and then store visits for last-minute shopping for fresh and festive food for family, friends and the new year celebrations. However, with shoppers spending around 18% more on their groceries than two years ago, many were mindful of overspending, economised early in the quarter and overall bought less volume in eight out of the 12 weeks.”

Watkins added: “With low everyday pricing and loyalty card savings now key strategies across the industry, retailers will need to refocus on how they differentiate and offer other reasons to choose their stores to help sales growth and rebuild store equity. Yet promotions will still be important for footfall and sales growth, particularly after two years of falling FMCG volumes due to inflation.”

“Looking ahead, it’s likely that the cautious shopper sentiment seen in 2023 will continue for the first part of 2024, but from late Spring onwards, we can anticipate confidence slowly improving. The NIQ outlook for 2024 is that Total Till growth will be around 5%, but this depends on where food inflation lands during the year. Even so, we can expect to see FMCG volumes turning positive as the year progresses.”