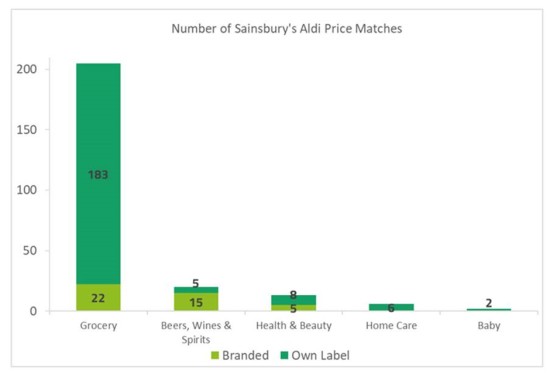

Over 80% of Sainsbury’s recent wave of Aldi price-matches are in its own label grocery products, which consists of ambient, chilled and frozen products. However, the largest reductions on branded items outside of the grocery category was in beers, wines and spirits, reveals new data from analysts at Edge by Ascential.

Following Sainsbury’s announcement this week that it was cutting prices on over 250 popular grocery items to price-match Aldi, Edge Digital Shelf conducted analysis into the categories and products included in the price cuts, confirming that, as of 11 February, there are 246 price cuts with an Aldi Price Match promotion across the grocery, home care, beers, wines and spirits and health beauty categories, with an average reduction of 13.5%.

The research found that the largest Aldi price-match reductions from Sainsbury’s are in its home category (23.5%) followed by frozen foods (16.9%) and health & beauty (16.1%). 69% of the price matched products were reduced between 10th-11th February, but the vast majority were already at a low price.

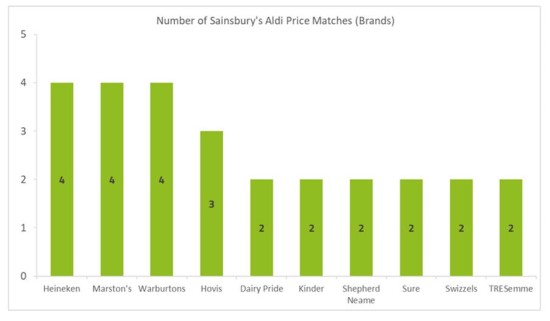

The analysts from the Edge Digital Shelf e-commerce platform found that in the grocery category, fresh meat had 37 Aldi price matches – all own label – followed by dairy which had 29, of which only two were branded. The most price matches on branded goods within grocery were in the bakery category, where there were four price matches on Warburtons bread and three on Hovis loaves. However, the most branded price matches outside of grocery were in beers, wines and spirits.

Within beer, brands owned by Heineken, such as Fosters, Kronenbourg 1664 and John Smiths, and brands owned by Marstons such as Wychwood Hobgoblin and Old Empire, had the greatest number of price matches ahead of Shepherd Neame, Stella Artois and Thwaites.

Chris Elliott, Head of Market Insights at Edge by Ascential, commented: “Sainsbury’s has followed in the footsteps of Tesco by challenging discounter Aldi with its new price matching scheme. It’s evident that in order to keep prices as low as possible, the retailer has had to focus the majority of its price cuts in its own label ranges, but there are some branded items – particularly within alcohol categories which are competitively priced.”

He added: “Aldi keeps its prices so low that the discounter may not be able to further drop the prices of its items without losing significant margin. What we are likely to see in response is Aldi placing more attention on lowering the prices of its other products outside of these price matched items in order to compete with its rivals. This will be a similar approach to its response to Tesco’s price match scheme in March 2020.”

NAM Implications:

- Own label can be a difficult like-with-like basis for comparison for shoppers.

- Therefore BWS brands may provide some cherry-picking shopping opportunities.

- Key will be the overall impression given the shopper…