Data released by NIQ shows total till sales in UK supermarkets grew 3.7% over the four weeks ending 30th November, down slightly from the 4.0% rise recorded in the previous month. The slowdown was said to be due to milder weather, Black Friday distraction, and shoppers holding out for the big Christmas shop.

Meanwhile, shoppers appear to be actively looking for discounts, with the data revealing a significant uplift in visits to stores (+5.7%) ahead of online shopping occasions (+0.6%). As a result, online’s share of FMCG fell to 13.1% from 13.4% last year.

Over the month, the percentage of sales purchased on promotion edged up from 24% to 25% as shoppers sought ways to save money. NIQ noted that brands have been looking to drive incremental sales and basket spend through more in-store promotional activity and increased loyalty app discounts. ‘Personalised Savings’ is thought to have unlocked this discretionary spend, with 38% of households set to use vouchers and points saved up for their Christmas groceries this year.

Black Friday also coincided with payday at the end of the month, seeing value growth sustained at the grocery multiples in the last week of November. Shoppers cashed in on higher priced items while on promotion, such as 25% off six bottles of wine and beauty & gifting offers. However, NIQ said this likely resulted in consumers holding back on spending on other items, such as storage cupboard food, frozen, and household basics, where growth was flat.

In terms of category growth, the data shows that Health & Beauty experienced an uplift in sales (+6.9%), likely helped by Black Friday discounts. However, beer, wines and spirits (BWS) continued to struggle as value sales fell (-3.8%), and there was no corresponding increase in unit sales (-2.5%) compared to a year ago.

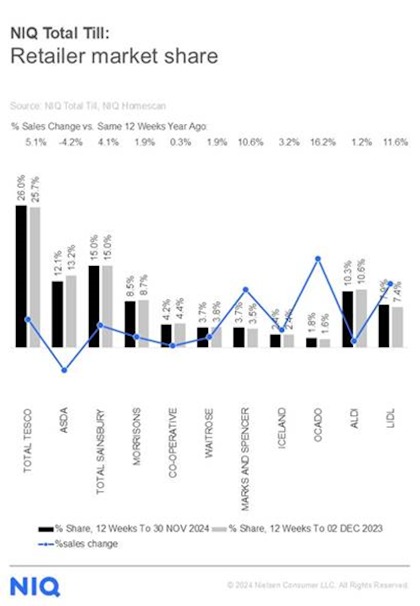

In terms of retailer performance over the last 12 weeks, Ocado (16.2%) remained the fastest-growing retailer, followed by Lidl (+11.6%) and Marks & Spencer (+10.6). Tesco also continued its robust growth (+5.1%).

With sales in the sector expected to accelerate over the next two weeks, Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commented: “Last year, with food inflation at 7% (BRC NIQ SPI), volumes fell in December 2023. However, this year NIQ expects volume growth of around 1%.

“Even with 50% of households saying it is important for them to make savings on their Christmas groceries this year, 66% still expect they will spend the same or more than last year (NIQ Homescan Survey), and 38% intend to use points or vouchers saved up. So there are reasons to be cheerful”.