Latest Kantar data shows that take-home value sales in Ireland over the four weeks to 26 January climbed 6.5% year-on-year as supermarkets ramped up promotional activity to attract cash-strapped shoppers after the costly Christmas period. This helped drive down grocery price inflation, which eased to 3.4%, from 3.6% in December.

January also saw shoppers returning to stores more often, making on average 23 trips, but picking up less volume per trip, which was down 1.6% versus last year.

“Supermarkets were rolling out discounts in the New Year, as a way of easing the pressure on household budgets – and Irish consumers were more than happy to take advantage of them,” said Emer Healy, Business Development Director at Kantar.

“Spending on promotion rose by 8.4% with shoppers spending an additional €72m versus last year. This is the highest level of sales on promotion we’ve seen since February 2021.”

Alongside promotions, Irish shoppers turned to supermarket own label lines to help keep costs down in January. Sales of these products jumped 6.9% compared to last year, with an additional €103.9m being spent on these ranges. Overall, own label holds 44% value market share. Brands also saw growth, albeit behind the total market at 5.3% compared to last year.

Meanwhile, the Kantar data confirms that shoppers started the new year with a focus on health and wellness. An additional €8.9m was spent on fresh fruit and vegetables combined, and there was also a boost in spending on healthcare products, which were up 8.6%.

Healy added: “Dry January was in full swing this year, with 6.2% of all Irish households purchasing non-alcoholic drinks in January. Sales of low and no-alcohol soared by over 47%, with shoppers spending an additional €620k during the month versus last year. However, not everyone took part in Dry January this year as shoppers also spent an additional €7m on beer and cider.”

Online sales rose by 14.5% year-on-year, with shoppers spending an additional €27.4m through the channel. Over the latest 12-week period, the number of online shopping trips increased by 11.7%, boosted by new shopper recruits, with over 19% of Irish households now purchasing online.

At the end of January, Ireland experienced Storm Éowyn, the country’s most powerful storm in years. The storm also impacted shopping habits, with consumers stocking up on necessities, leading to Tesco (+8.9%), Dunnes (+8.1%), and SuperValu (+8.5%) outperforming the total market throughout January (+6.5%).

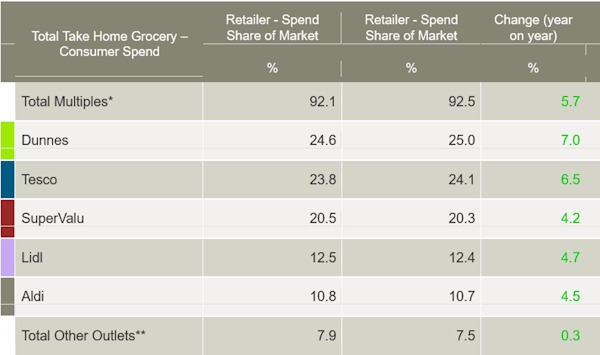

Over Kantar’s 12-week analysis period, Dunnes reached a new record market share of 25%, with sales growth of 7% year-on-year. Shoppers increased the number of trips while picking up more packs per trip, which contributed a combined €39.2m to their overall performance.

Tesco held 24.1% of the market, with value growth of 6.5%. Shoppers increased their trips to its store alongside new shoppers, which contributed a combined €21m to overall performance.

SuperValu controlled 20.3% of the market with growth of 4.2%. Consumers made the most shopping trips to this grocer, averaging 23.8 trips over the latest 12 weeks. The increase in the number of shopping trips contributed an additional €40m to its performance and strengthened results at the start of 2025.

Lidl saw growth of 4.7% after increased trips to store and new shoppers drove an additional €8.7m in sales. Sales at Aldi rose 4.5%, with an increase in trips contributing an additional €13.3m to its performance.

NAM Implications:

- A combination of promos and storm-precaution necessities appear to have driven January’s performance.

- Meanwhile, brands attempted to win/buy back allegiance from own label.

- Could be a risk assuming that the growth of retail media might cause retailers to modify the appeal of own label (price-wise)…

- …to increase the appeal of RM investment by brands.

- The key is checking the extent to which you achieved and held your fair share of Ireland’s five major retailers.