Latest data from Nielsen shows that online sales accounted for 13% of all UK grocery spend in the four weeks ending 16 May, totalling £1.2bn. This is up from 7% at the same time last year and the 10% share recorded just four weeks ago as people continued to adapt their shopping habits amid the lockdown.

Around 7.9m households placed an online grocery order in the four week period, up from 4.8m last year, with 1.1m of these being new online shoppers in the last month.

The growth of online sales in the last four weeks (+103%) is a significant increase compared to the 6.6% sales growth in bricks & mortar stores. Nielsen’s data reveals that store visits were down by 24% in the last four weeks, although spend per visit was once again higher than at Christmas – up 45% compared to this time last year, with an average basket value of £21.60.

Total till sales in the last four weeks grew 13% year-on-year. Categories that performed well included beers, wines and spirits (+32%), frozen food (+31%), packaged grocery (+24%), and meat, fish and poultry (+19%), with health, beauty and baby care (-19%) and delicatessens (-12%) recording the biggest declines.

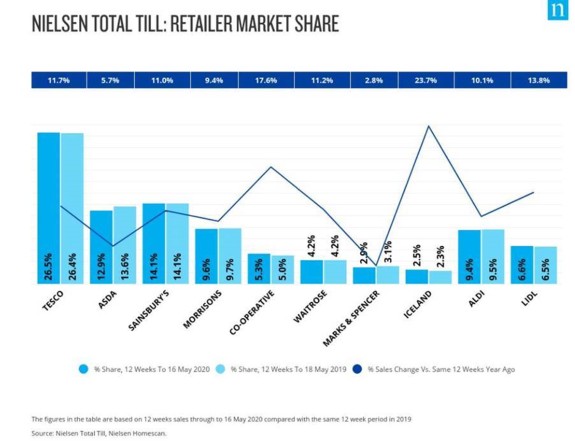

In terms of the last twelve weeks, which covers pre-lockdown and the full lockdown period, Iceland’s growth (+23.7%) is well ahead of the pack, with the Co-op (+17.6%) also gaining market share. Growth at major supermarkets ranged from +6% growth at Asda to +12% growth at Tesco. The slowest growth came through from M&S (+3%), impacted by the closure of their non-food stores.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “Following over eight weeks in lockdown, UK shoppers are more accustomed to restricted living, and have adapted their grocery shopping habits to match. The extreme category growth experienced at the beginning of lockdown has started to ease as consumers become more confident in product availability. Online has been a clear winner over the lockdown period, as shoppers take advantage of retailers’ increased delivery capacity.”

He added: “With social distancing continuing to be a way of life for the foreseeable future, online shopping will continue and shoppers will begin to add more discretionary treats and indulgences back into the weekly shop. We’ll also continue to see an increase in basket sizes, as consumers focus on cooking their own meals whilst pubs and restaurants remain closed. More meals cooked at home will also boost grocery spend across major categories including frozen, fresh and chilled foods. The warm weather may even increase spend further as shoppers buy additional food and drink items, and households make the move to alfresco dining and treating themselves.”

12-weekly % share of grocery market spend by retailer

and value sales % change

NAM Implications:

- Only surprise is the pace of change is not faster…

- Meanwhile, important to check your performance vs these categories.