Latest industry data from Nielsen confirms that UK supermarkets experienced their biggest Christmas ever last month, with the online channel playing a key role.

The online share of grocery sales more doubled to 12.5% (6.7% in 2019) over the four weeks to 26 December. The rise was due to a total of 8.5m households, just over 30% of all households, shopping for their Christmas groceries online, an increase from 5.7m households over the festive period in 2019.

While visits to stores declined by 10%, overall and including online, shoppers increased their spend per visit to an average of £20, up from £17 a year ago, the biggest ever spend per visit during the Christmas period, and only slightly lower than the all-time high of £22 recorded at the height of the lockdown in May.

The Nielsen data shows that total till sales in the four-week period grew by 8.4% with almost £12bn spent at supermarkets, including £1.3bn online. However, the additional pandemic restrictions signposted mid-December lead to households planning for smaller family celebrations and holding back some spend in the final two weeks leading up to 24 December.

With Covid-19 restrictions also impacting social gatherings and large family celebrations, purchasing fell heavily on the immediate family and not extended family and friends, as many consumers took the opportunity to enjoy a less traditional Christmas meal.

This is reflected in Nielsen’s data which shows increasing sales for less traditional meal items such as frozen dumplings (+77%), beef fillets, medallions, and steaks (+57%) and fresh sea bass (+48%). There was also a surge in demand for more convenience food such as frozen croissants (+70%), coffee pods (+56%) and handheld ice creams (+45%). With fewer socialising and gifting opportunities, sales of confectionery (+2%) were subdued.

Beer, wine and spirits was the fastest-growing category overall and traditional indulgences were still popular with consumers, with sales up for champagne (+18%) and crémant sparkling wine (+51%). Many consumers also marked the festivities by experimenting with cocktail making, with a significant increase in sales for tequila (+59%), flavoured vodka (+50%) and spiced rum (+47%).

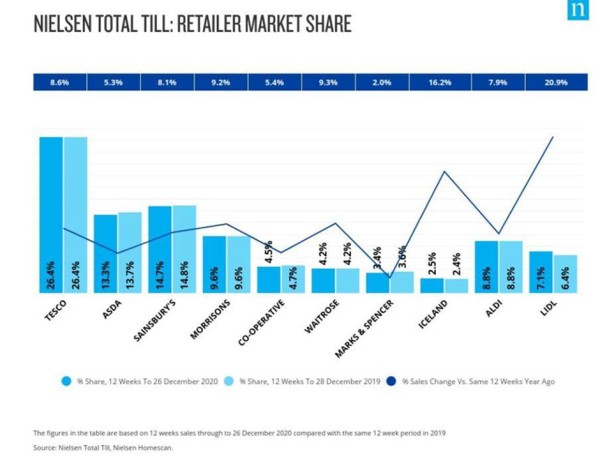

In terms of retailer performance over the longer 12-week period ending 26 December, Lidl led the way with bumper growth of 20.9% year-on-year. This was well ahead of key rival Aldi, which continued its recent run of comparatively weak performance with sales up only 7.9%.

Morrisons was the top performer among the Big Four supermarkets with growth of 9.2%. Waitrose also recorded strong growth (+9.3%), although it was a disappointing month for its key rival M&S. The retailer, which has spent the last year revamping its food offer, usually does relatively well at Christmas but this year only recorded growth of 2%.

12-weekly % share of grocery market spend by retailer and value sales % change

Commenting on the data, Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “2020 marks the first Christmas where online shopping played a significant role in consumers’ shopping behaviours, with 85% of the incremental sales in food and drink made online in the last four weeks ending 26th December. Although overall grocery growth was a little lower than in November, this takes into account the many challenges consumers faced around restrictions and cancelled Christmas plans.”

Watkins continues: “It has certainly been an unusual Christmas for us all, and this has affected purchasing decisions. The pandemic has changed how we live, shop and consume and despite consumers celebrating the festivities in smaller groups, food and drink remained at the heart of celebrations. With fewer people to entertain and cater for, many households took the opportunity to enjoy less traditional meals.”

NAM Implications:

- Given the relative performance of Lidl and Aldi…

- …are we about to witness a battle of the discounters for share in 2021…?

- If so, on what basis?