Latest data from Kantar shows take-home grocery sales in Ireland increased by 4.7% in the four weeks to 12 May 2024, boosted by better weather and the bank holiday during the period.

Volumes per trip were up slightly at 0.2%, while frequency also increased by 1%, with shoppers making 21 trips on average over the month of May. Average prices grew by 1.8% in May, up on last month’s 0.7%.

Grocery inflation over the 12 weeks to 12 May was 2.6%, down 13.3% compared to the same period last year. Kantar noted that grocery price inflation remains the driving factor of higher value sales rather than increased purchasing.

Emer Healy, the research firm’s Business Development Director, commented: “Once again, we see grocery inflation fall for the thirteenth month in a row – now sitting at the lowest level we have seen since March 2022. This is welcome news, but Irish consumers are still looking for bargains with over 25% of value sales on promotion, down 4% since January 2024.”

The data also shows that retailers are promoting their own-label ranges to get shoppers through the door. Over the 12-week period, sales of own-label grew ahead of the total market at 5.7% year-on-year, with shoppers spending an additional €86m.

Premium own label performed particularly well, with shoppers spending an additional €18.4m, up 12.6% compared to the same time last year. Brands grew by 4%, slightly behind the total market, with shoppers spending an additional €59m.

Online sales were up 18.6% with shoppers spending an additional €31.3m in the channel. Larger trips contributed an additional €12.5m, together with new shoppers and more frequent trips, which contributed a combined €9.8m to online growth.

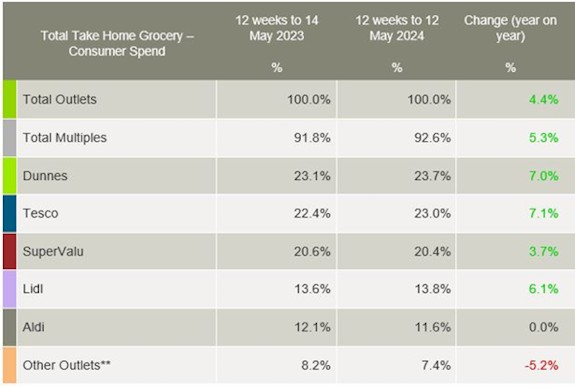

Looking at the performance of individual retailers, spending in Dunnes grew 7.0%, boosting its market share to 23.7%. Its growth stemmed mainly from more frequent trips, up 4%, contributing €29.7m to overall performance.

Tesco held 23% of the market after recording growth of 7.1%. It had the strongest trip frequency growth amongst all retailers for another month in a row, up 8.7%, contributing an additional €61.2m to overall performance.

SuperValu held 20.4% of the market after seeing growth of 3.7%. Its shoppers made the most trips in-store compared to all retailers, an average of 21.6, and the retailer also experienced the strongest growth in volume per trip, up 8.9%. This contributed an additional €56.2m to SuperValu’s overall performance.

Meanwhile, Lidl recorded growth of 6.1%, with more frequent trips contributing an additional €42.2m to its overall performance. Aldi’s market share slipped to 11.6% despite new shopper recruits and more frequent trips contributing an additional €15.4m to its overall performance.

NAM Implications:

- Some (small) green shoots emerging…

- …with a reluctant population requiring promoted own-label to encourage shop visits.

- Although traditionally a brand-loyal market…

- …suppliers have to be mindful that a brand loyal trading down may find that own label equivalents are not as big a compromise as anticipated…

- …and may be expensive to win back.