Latest data from Kantar shows grocery price inflation fell 1.6 percentage points to 14.9% in the four weeks to 9 July, the steepest decline since it peaked in March this year. Take-home grocery sales over the same period grew by 10.4% compared with 12 months ago.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Grocery price inflation has now been falling for four months in a row. That will be good news for many households although, of course, the rate is still incredibly high.”

Kantar noted that the change came as spending on promotions rose for the first time in two years, now accounting for 25.2% of the total market. One of the biggest shifts in this area is retailers ramping up loyalty card deals like Tesco’s Clubcard Prices and Sainsbury’s Nectar Prices. McKevitt suggested that this could signal a change in focus by the grocers who have previously been concentrating their efforts on everyday low pricing, particularly by offering more value own-label lines.

He added: “The boost to promotional spending has contributed to bringing inflation down but this isn’t all that’s driving the change. Prices were rising quickly last summer so this latest slowdown is partially down to current figures being compared with those higher rates one year ago.”

At the current level of inflation, Kantar’s figures suggest that households would have had to spend £683 more on their annual grocery bill to buy the same items as they did a year previously. However, consumers have adapted their habits to limit this increase, trading down to cheaper products or visiting different grocers. The average annual increase in household spending over the past 12 months has actually been £330 – well below the hypothetical £683.

McKevitt also highlighted that the trend towards bigger shops has stuck. “We’re visiting the supermarkets less often than we did before the pandemic and buying more when we’re there,” he said. “Compared to last year, trips to the store have only gone up by 1%. At that rate of change it would take until 2028 for us to get back to 2019 levels. While some people may be shopping less often to manage spending, this is also linked to more people working from home. That has led to fewer opportunities to pop into the shop on the way to or from work.”

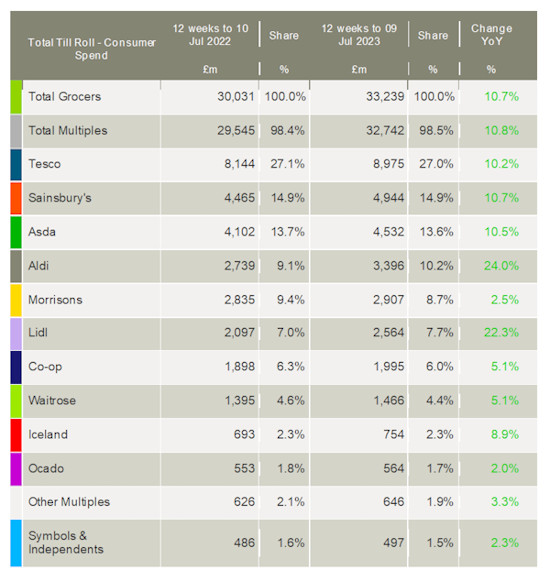

Meanwhile, the data confirms that competition for market share among Britain’s three largest grocery retailers remains intense. Sainsbury’s sales growth edged ahead this month, marking the first time since January this year it has led Asda and Tesco. It grew by 10.7% and maintained its share of the market for the third consecutive month at 14.9%. This was just ahead of Asda and Tesco, which increased sales by 10.5% and 10.2%, although both saw a slight loss in market share to 13.6% and 27.0% respectively.

Aldi was again the fastest-growing grocer in the UK, with sales up by 24.0%. It now holds 10.2% of the market, up from 9.1% a year ago. Lidl increased its market share, up by 0.7 percentage points to 7.7%, with sales increasing by 22.3%.

Morrisons saw growth of 2.5%, its best showing since April 2021 and its eighth month in a row of improved performance. Both Waitrose and Co-op grew by 5.1% over the 12 weeks, the largest boost both retailers have experienced since March 2021.

NAM Implications:

- Inflation at 14.9% vs sales increasing at 10.4% means serious volume falls for the mults.

- Making discounter growth of 24% even more threatening for rivals…

- …with discounter combined share of 17.9% adding to the mults’ pain.

- Meanwhile, mults playing follow-my-Tesco-Clubcard-leader has to benefit shoppers.

- Time to check out your fair share, on all fronts…