Online sales accounted for 16% of the UK grocery market during January – the highest ever level after exceeding the last peak in June (14%) and double what it was the same month last year as demand continued to increase during the latest lockdown.

The data from NielsenIQ shows online grocery sales jumped 121% to £1.4bn over the four weeks ending 30 January with a large proportion of this expenditure coming from new online shoppers who spent an equivalent of £770m. 1 in 3 of all British households shopped online (9.3m) and 4.1m of these shoppers were new to the channel.

The growth of the online channel follows another strong month for the grocery market as the shutdown of the hospitality sector continues to curtail out of home eating.

NielsenIQ’s total till data shows sales last month increased by 10.6%, also the highest growth since June last year. This is despite January typically been a month of subdued growth following the bumper festive period.

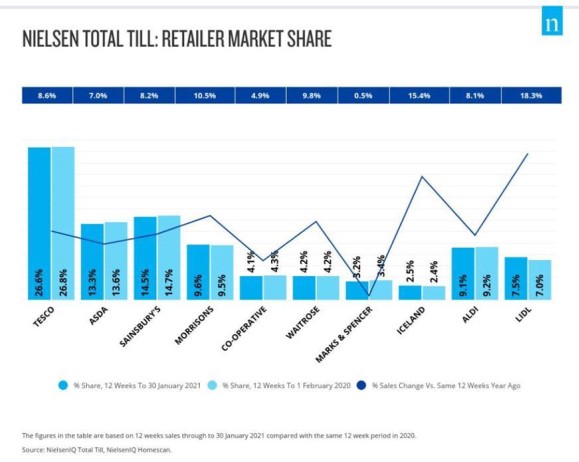

In terms of retailer performance, Morrisons (+10.5%) was the only Big Four supermarket to gain market share over the last 12 weeks. However, there was also strong performance from Lidl (18.3%) and Iceland (15.4%).

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, commented: “It has been an extraordinary January for British supermarkets. This was spearheaded by the exceptional growth in online grocery, in which there were 24 million online shops made – up from just 11 million last January. This growth has once again been driven by increased demand throughout the third lockdown as shoppers shifted spend away from stores where overall growth was flat. Retailers were able to flex their capacity in home delivery and increasingly in click and collect to meet the unprecedented number of new online shoppers.”

Looking ahead, he said: “We anticipate that this level of spending will remain consistent throughout February, however we will see growth fall in March given the comparative 21% growth of last March, and we estimate that growth for the full quarter will level out at between 1%-3%.”

NAM Implications:

- Two key questions:

- How much accrues to Amazon?

- How much permanent damage to hospitality?

- Worth conducting what-ifs re Hospitality maximum recovery no more than 50%…

- …if that…