The online share of grocery sales rose 1% last month to reach a record 17%, whilst wider data suggests shopping patterns have come full circle with sales of cupboard necessities falling for the first time since the pandemic began in the UK.

The latest sector analysis by NielsenIQ shows British shoppers spent £1.5bn on online groceries over the four weeks ending 27 February. The number of households shopping for their groceries online has now more than doubled in the last year, reaching 41% compared to 18% at the same point in 2020. This is equivalent to 11.8m households and is a 132% increase in sales compared to the same period last year. In contrast to this, sales at bricks & mortar stores declined by 1% year-on-year in the four week period.

In total, grocery sales for February grew by 10.6% year-on-year, the same figure from the previous four week period. However, this remains at the highest level since June 2020, when sales growth peaked at 14%.

Despite the strong levels of grocery sales, NielsenIQ’s data shows that in the one week period ending 27 February, consumers are now spending less on essential items that were previously involved in mass purchasing. This includes sales of rice and grains (-15%), dry pasta (-18%), canned or packet soup (-19%) and toilet rolls (-12%) which have all declined in sales since the panic buying began early in the crisis. This reflects the fact that sales for these items first shot up this time last year as discussions of a lockdown began, and one year on, we now see the tide beginning to change as British consumers look ahead to restrictions lifting.

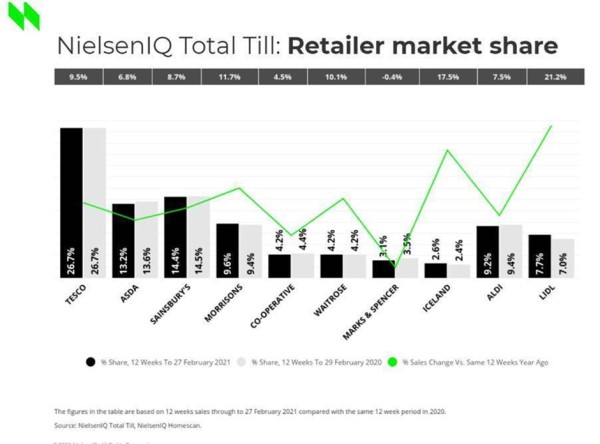

In terms of retailer performance, Lidl (21.2%) delivered the strongest growth over the longer 12 week period, which NielsenIQ attributed to the success of the discounter’s loyalty app. Iceland (17.5%) also followed with strong sales growth, whilst Morrisons (11.7%) continued to outperform the other Big Four rivals.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “One year on since the pandemic began in the UK it’s evident that a lot has changed in terms of consumer shopping patterns. Online grocery has now become a permanent fixture for many UK shoppers – it is now past the ‘tipping point’ and is at the ‘sticking point’. Consumers no longer feel like they have to shop online, but do so because they prefer to, particularly now that many retailers have expanded fulfilment capacities. Even when we exit lockdown and start to return to some normality, we anticipate that online demand will continue to grow ahead of the market.”

He added: “It has been one year since panic buying began, and in the final week of February 2021 we saw decline in the ambient – shelf stable food – category for the first time in a year. As vaccination programmes prove successful and with the government outlining a clear roadmap out of lockdown, it’s clear that this has been a boost to consumer confidence and signals another change in purchasing habits.”

12-weekly % share of grocery market spend by retailer

and value sales % change