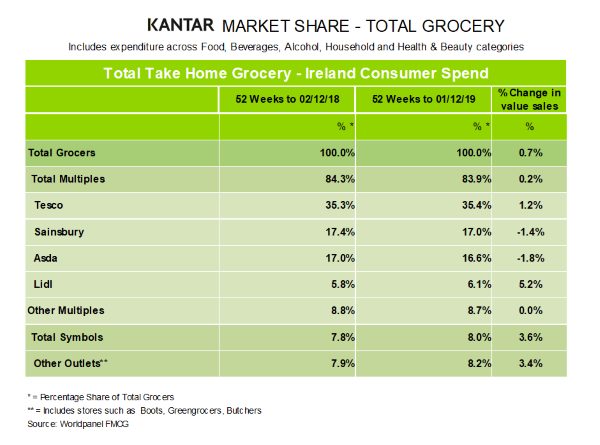

Growth in the Northern Irish grocery market held steady at 0.7% during the 52 weeks to 1 December 2019, according to latest data from Kantar.

A decline in volume sales slowed to 0.2% year-on-year as people continued to make additional trips to the shops – on average 261 visits over the course of the year, which is 10 more than last year.

Commenting on individual retailer performances, Charlotte Scott, consumer insight director at Kantar, said: “Lidl was the best performing retailer this period with sales 5.2% higher than the previous year and it gained 0.3 percentage points of market share as a result. Existing customers visiting stores less often was offset by a rise in pack prices, which were up 4%. The retailer’s performance was also helped by attracting new shoppers and encouraging bigger baskets.

“Sales at Asda and Sainsbury’s slowed this month, by 1.8% and 1.4% respectively. Penetration at Asda has fallen by 1.7%, driven by shoppers making fewer trips and reducing basket sizes. Sainsbury’s has increased its penetration by 0.2% – but shrinking basket sizes, down by 2.2%, has limited its growth.

“Tesco remains the only one of the three largest retailers to achieve growth in the past 52 weeks – increasing its market share to 35.4% with sales up by 1.2%. An increase in shopper frequency outweighed falling basket sizes as Tesco customers made an average of seven more trips to the retailer this year than they did this time last year.”

Similar Kantar data released yesterday for the Republic of Ireland showed robust growth in the grocery sector with SuperValu overtaking Tesco in the retailer rankings.