Latest data from NielsenIQ shows total till grocery sales at supermarkets in the UK fell 4.1% over the four weeks ending 26 March, continuing the downward trend against tough comparatives seen in February when sales fell 3.4% after falling 2.9% in January. However, this is the final figure measuring sales growth against the high lockdown demand for groceries, suggesting a potential return to growth in the months ahead.

The figures reveal that online sales fell 19% compared with the same period last year, while sales at bricks & mortar stores edged down 0.6%. However, this is in line with expectations given the lockdown comparatives last year, where online sales surged 92%, and is an indication that the normalisation of post-pandemic shopping behaviours is almost complete. NielsenIQ data shows that store visits rose 5% over the last four weeks, and the overall online share of sales has stabilised at 12.4% having been 14.8% this time last year.

Similarly, spend per visit across all channels is unchanged at £18.52 in March (£18.50 in February), while promotional spend on offers also remained unchanged at 20% of sales purchased.

Amid concerns about inflation and the cost of living, the data appears to confirm that shoppers are starting to shift their spend towards supermarket private label products. In the four weeks to 26 March, the share of sales for FMCG private label products has risen from 52.4% to 53.2% compared to a year ago. Sales of branded FMCG products declined 5.1%, while overall sales of private label products were down just 1.9%.

Moreover, sales of private label products in the ambient (shelf-stable food) grocery category increased by 3.3% in the last four weeks; a significant change in a category where brands dominate with 61% share of total sales.

In terms of category performance, beers, wines and spirits (-17.6%) and confectionery (-21.9%) experienced the steepest declines in sales against last year. For confectionery, this is likely due to Easter being two weeks earlier in 2021. Meanwhile, pet food and pet care (+12.7%) and health & beauty (+11.8%) experienced the fastest growth as shoppers returned to pre-pandemic behaviours.

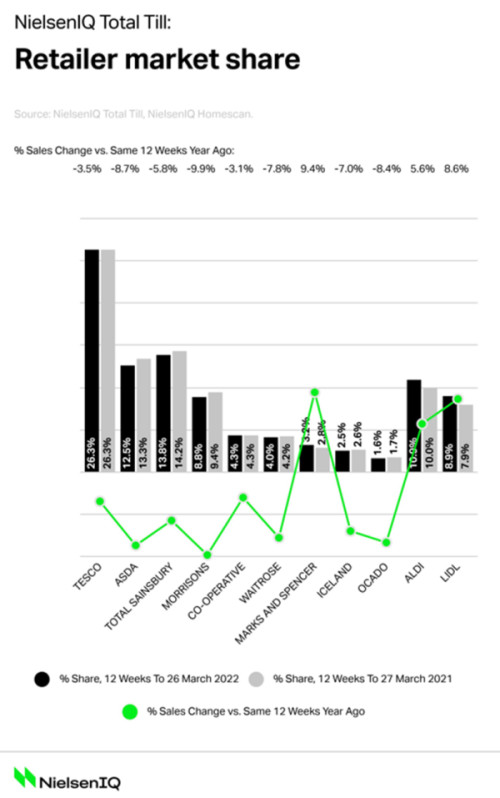

Looking at the performance of individual retailers over the last 12 weeks, Marks & Spencer continued to experience the fastest growth (+9.4%), followed by Lidl (+8.6%) and Aldi (+5.6%), with these the only retailers to gain market share.

“As we leave behind the pandemic, it`s clear that shoppers are re-evaluating what they spend, said Mike Watkins, NielsenIQ UK Head of Retailer and Business Insight. “Whilst some of the changes in grocery spend will be due to consumers simply having a different basket mix compared with last year, our data also shows that consumers are now increasingly shopping for private label products as part of their coping strategy.

“We are therefore beginning to see three trends emerge. The first will be more spending on private label products as this still gives shoppers choice, from economy products through to premium. We’ll also see an increase in ‘trading down’ of products as shoppers seek to make more savings. Finally, we’d anticipate an overall shift of spend to retailers that are perceived to offer value for money. This will not only be discounters like Aldi or Lidl or other value retailers such as Poundland, Home Bargains and B&M but any supermarket with a strong price message, for example retailers offering differential price discounts for users of loyalty apps, reward threshold vouchers or fuel vouchers”.

Watkins concluded: “Whilst saving money on discretionary areas such as clothing and eating out are some of the immediate ways that households will economise, this does suggest there could be some impact on grocery shopping as the cost-of-living squeeze accelerates during Q2.”

NAM Implications:

- Key takeaways: More private label, trading down, seeking Value retailers.

- An obvious fallout from Lockdown and Ukraine-induced shortages driving high inflation.

- As always worth checking your performance vs category and retailer…