New data released by NIQ shows Total Till sales growth at UK supermarkets slowed to 3.4% over the four weeks to 20 April, compared to the rise of 5.4% the previous month. This was due to inflation slowing again, the earlier Easter, and a drop in general merchandise sales (-8%).

However, the analysis reveals that shoppers took advantage of discounts and promotions in the weeks following Easter, with spending on promotions at 25.3% – up from 24% last month. This was driven by an increase in promotional activity from brands, with value sales of these items up 36% compared to 32% at the same time last year. However, own-label goods (+4.8%) continued to outpace branded lines (+4.1%) in sales across all FMCG categories.

The NIQ data also confirms that omnichannel shopping is now engrained in shoppers’ everyday lives, with over a quarter (27%) of households choosing to buy some groceries online over the four-week period. Online shopping sales rose 3.2%, with the channel’s share of FMCG sales the same as a year ago at 12.6%. There was also an increase in visits to stores (+1.5%) compared to last year.

Although food inflation is slowing, NIQ noted that food prices still remain significantly higher than this time last year, with shoppers choosing to dine at home more to save money. Over the four-week period, meat, fish & poultry (+6.7%) and produce (+6.4%) saw the biggest uplifts, with dairy also seeing strong growth (+4.8%). These three categories also saw the strongest unit growth at 5.0%, 4.1% and 4.8% respectively.

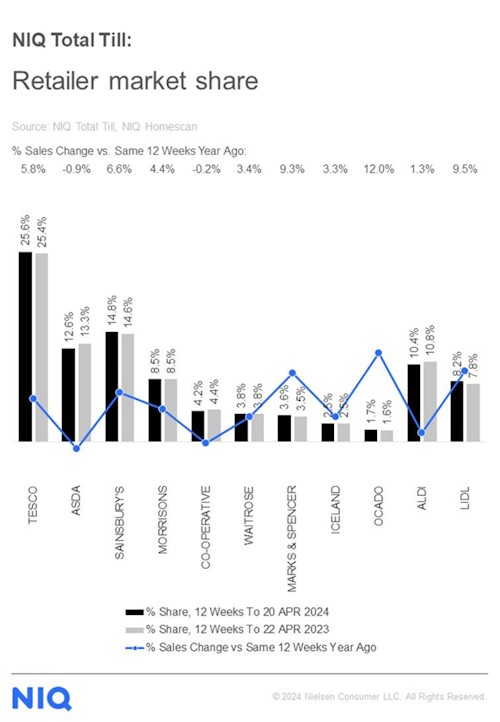

Meanwhile, over the 12 weeks to 20 April, Ocado was the fastest-growing grocery retailer, with its sales up 12%.

Sainsbury’s (+6.6%) and Tesco (+5.8%) continued to gain market share, with both seeing increased store visits compared to the same time last year.

Morrisons’ performance showed further improvement, with sales up 4.4% and its market share holding firm after spend per visit grew ahead of last year. However, Asda continued to struggle, with its sales slipping 0.9% and its market share falling from 13.3% to 12.6%.

Against tough comparatives, Aldi’s sales were up just 1.3%, and its market share slid from 10.8% to 10.4%. Key rival Lidl saw its sales jump 9.5%, with a further gain in share.

NIQ noted that as we head into the May bank holidays and hopefully better weather, there’s a chance that improving shopper sentiment will drive sales growth in the weeks ahead. The research group pointed to its latest Homescan Survey, which shows that fewer consumers (51%) now feel they are moderately/severely impacted by the cost-of-living squeeze than at the end of 2023 (57%).

Commenting on the data, Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “The early Easter brought forward some spend to March, so weekly growths in April were impacted. This in turn, exaggerated some of the slowdown in growth, which we were already seeing. However, the growth week ending 20th April at the major supermarkets was 2.6% and may be indicative of the level of growth now that inflation is in low single digits. We can also expect the gap in growth between private label and brands to close further as shopper spend starts to normalise after 18 months of inflation.”

He added: “Even with lower food inflation and, for some households, improving personal finances, shoppers still need to be persuaded to spend. Therefore, we can expect promotional activity to continue to increase. With 49% of households now feeling that they are more insulated from the pressure on their personal finances, there is a potential that this cohort will be the first to start to spend more freely in 2024.”

Watkins concluded: “Shoppers continue to shop around for the best offers. But there is a question mark about spending on fashion, technology and homegoods, with holidays and leisure activities more likely to see an uptick when disposable income increases. This means that for food retailers, much depends on the weather improving in the next few weeks to help maintain sales growth as the comparatives are now starting to get a bit tougher.”

NAM Implications:

- Standout items:

- Why the Aldi loss of market share? Possibly funds going to overseas growth, thereby less price support in the UK?

- Where is Asda headed medium and long term?

- Can Morrisons maintain momentum, given debt issues?

- Own-label continuing to grow at the expense of brands, will it be possible to win the switchers back?