Following a record-breaking festive period, data from Kantar shows growth in take-home grocery sales in Ireland slowed to 2.2% over the four weeks to 21 January.

Although sales growth had weakened compared to the previous month’s 7.8% increase, shoppers still spent an additional €21.4m compared to the same time last year. Grocery inflation stood at 5.9% for the 12-week period, which is down 1.2 percentage points compared to the 7.1% recorded in December.

Emer Healy, Business Development Director at Kantar, commented: “Many Irish consumers are keeping a very close eye on their purse strings after indulging over the festive period and to help manage household budgets, many are trading down to supermarket’s own-label products and looking for deals.”

The Kantar data shows that the amount of sales on promotion grew 9.9% year-on-year with shoppers spending €92.6m more than last year, meaning that 28.9% of all value sales this period were on promotion.

Meanwhile, own-label lines continued to perform strongly, growing ahead of the total market at 8% year-on-year and holding a value share of 44.9% after shoppers spent an additional €117m.

Premium own-label ranges also performed well with shoppers spending an additional €157m on these lines, with growth of 10.3% when compared to the same time last year. Brands also saw growth over the 12 weeks of 5.2%, but this was slightly behind the total market.

“Health always becomes a top priority after an indulgent festive season, with many Irish consumers kicking off 2024 with good intentions,” Healy noted. “Shoppers cut back in more ways than one this month. Across Ireland, consumers took on ‘Dry January’ with alcohol sales falling by 8.6% and shoppers spending €7.4m less during January compared to last year. Sales of non-alcoholic beverages jumped 8.9% with shoppers spending €125,000 more year-on-year. Almost 7% of Irish households purchased in the category over January with a volume increase of 3.9%.”

However, Kantar highlighted that Veganuary didn’t have the same impact. Despite nearly 38% of Irish households purchasing chilled or frozen plant-based products, sales fell 2.6% with shoppers spending €200,000 less compared to last year. With many shoppers returning to normality after the festive break, it appears that many opted for ease when adjusting to routines and, as a result, spent an additional €3.3m on chilled convenience.

Online sales remained strong into 2024. In the 12 weeks ending 21 January, sales were up 17.7% year-on-year with shoppers spending an additional €28.2m. The main driver was more frequent trips, which contributed an additional €12.7m to its overall performance. Online continued to attract new shoppers with 18.5% of Irish households purchasing groceries online with volume up 0.8 percentage points year-on-year.

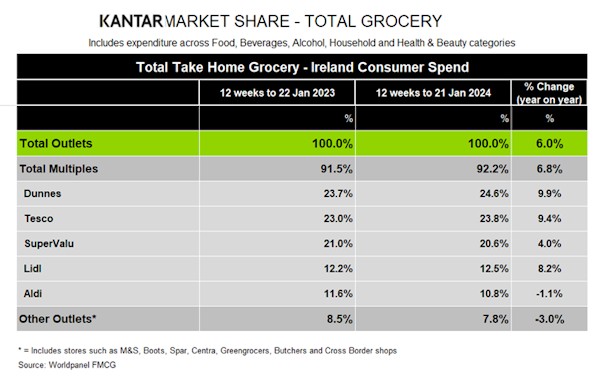

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month.

Dunnes hit a new record share of 24.6% with growth of 9.9% year-on-year. Its growth stems from a boost in new shoppers, up 1.3 percentage points, which is the highest growth in new shoppers among all the retailers, and alongside more frequent trips, contributed a combined additional €38.1m to overall performance.

Tesco held 23.8% of the market, also a new record for the retailer, with growth of 9.4% year-on-year. It had the strongest frequency of trips growth amongst all the retailers again, up 11.8%, which combined contributed an additional €88.4m to overall performance.

SuperValu controlled 20.6% of the market with growth of 4%. SuperValu shoppers made the most trips in-store when compared to all retailers, an average of 21.1 trips, contributing an additional €9.4m to overall performance.

Lidl held a 12.5% share after delivering growth of 8.2%. More frequent trips contributed an additional €30.9m to its overall performance. Meanwhile, Aldi saw its market share slip to 10.8% despite more frequent trips and new shopper arrivals contributing an additional €5.9m to its overall performance.

NAM Implications:

- Cutting back following Christmas celebrations is to be expected.

- As with the fall in alcohol sales and to an extent plant-based foods.

- Smaller, more frequent visits means less wastage.

- Key for retailers will be to grow basket size without sacrificing visit frequency.

- Meanwhile, growth in own-label, with the consumer having found them acceptable…

- …remains a threat for brands.

- Fortunately, the growth of retail media will help check own-label growth in favour of the big brands…

- …whilst spelling problems for the discounters.