Latest data from NIQ shows that total till sales at UK supermarkets rose by 3.3% over the four weeks to 18 May. This is in line with the figure reported last month (+3.4%) and was attributed to the brief period of warm weather during the week to 11 May, which pushed value growth to 5.1% – a two-month high (with the exception of Easter).

Sales did fall slightly once the rain returned, but the figures are in line with expectations given that supermarkets faced tough comparatives with the same period last year, which included a double Bank Holiday, the King’s Coronation and consistently good weather.

FMCG volumes grew 1.8% this month as shoppers bought ice cream (+55%), cider (+32%), pre-mixed alcoholic drinks (+28%) and mineral water (+26%) to enjoy the brief spell of warm sunshine.

The NIQ data also shows that visits to stores increased by 2.8% over the four-week period, equating to an additional 14.3m visits compared to last year. And while this led to fewer shoppers using the online channel, those that did shopped more often. This led to the number of online orders increasing 4.1%, with the channel’s share of FMCG spend increasing slightly to 13.0% (up from 12.7% a year ago).

With more shoppers out and about in the sunshine, this also led to an uplift in FMCG spend in the convenience channel (+3.9%).

NIQ found that there was no change in terms of spending on promotion over the four weeks, with it remaining at 25%. This averaged 36% for brands (up from 33% last year) and 16% for own-label items (up from 15% last year).

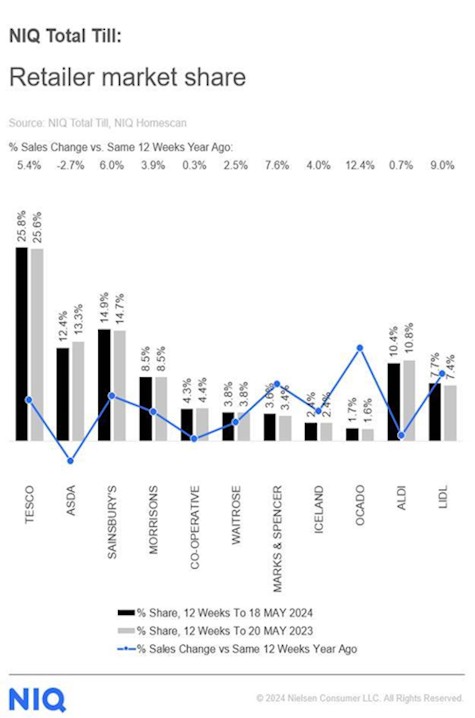

In terms of retailer performance over the last 12 weeks, growth was led by Ocado (+12.4%), while Sainsbury’s (+6.0%) and Tesco (+5.4%) continued to perform well. Sales growth at M&S slowed to 7.6% due to last year’s high comparatives, with Aldi and Lidl also experiencing slowing sales.

Asda was the only retailer where sales declined compared to last year. However, there were more visits per shopper to Asda than a year ago, and footfall was helped by the rollout of the group’s Express convenience format.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Over the last four weeks, we’ve noticed that it was the warm weather which helped to move the dial in terms of shopper spending at the UK supermarkets, more so than food inflation, which is expected to remain at around 3% for the next few months. Despite this, many shoppers are still faced with limits to their discretionary spend, and this is having an impact on certain categories, so retailers must focus efforts on driving food and drink sales.”

He added: “With weather being such a big factor in driving shopping behaviour, trading over the next few weeks will be challenging as last year marked the hottest June on record. Yet we do have a summer of sport to look forward to, and with at least 45% of UK households interested in the UEFA Euro 2024 tournament, this should kick-start sales again. Our data shows that of these, 69% plan to watch the matches at home by themselves or with other household members, meaning this could be a boon for supermarket sales of drinks, snacks and food for event-driven categories, such as barbeques.”

Watkins concluded: “Given that we have seen that shoppers were responsive to a week of sunny weather in May, retailers and suppliers will need to remain agile to respond to this with relevant promotions and good availability when summer finally arrives.”

NAM Implications:

- Limits on discretionary spending patently still an issue…

- (and presumably, suppliers cutting back accordingly?)

- Meanwhile, apparent opportunities for brands that can accommodate celebrate-at-home sports occasions.