Latest data from NielsenIQ (NIQ) shows total till sales growth at UK supermarkets slowed to 3.7% during the four weeks ending 9th August, down from 5.8% recorded in July.

The research firm suggested that following the early summer heatwaves, along with treating themselves during a summer of sports, shoppers chose to dial back their spending to save money amid increasing food inflation, which now stands at 4% (NIQ-BRC SPI). This led to a drop in average spend per visit (-3.1%) compared to this time last year. However, visits increased 6.2% as shoppers looked to take advantage of retailer promotions, which accounted for 23% of value sales across all stores.

NIQ highlighted that with shoppers looking for more budget-friendly, quick meal solutions, ‘Dinner for Tonight’ shopping missions are increasing, with one in five shopping trips consisting of quick, small baskets of fresh food, chilled meat and fruit and vegetables. Also amongst the fresh and ambient categories in growth were dried vegetables and pulses (+28%), fresh pastry and dough (+15%) and packaged grocery (+4.2%). Frozen fruit also saw strong demand, growing 13.2% in value and 7.0% in units as shoppers turned to waste-free options for smoothies, crumbles and breakfast pots.

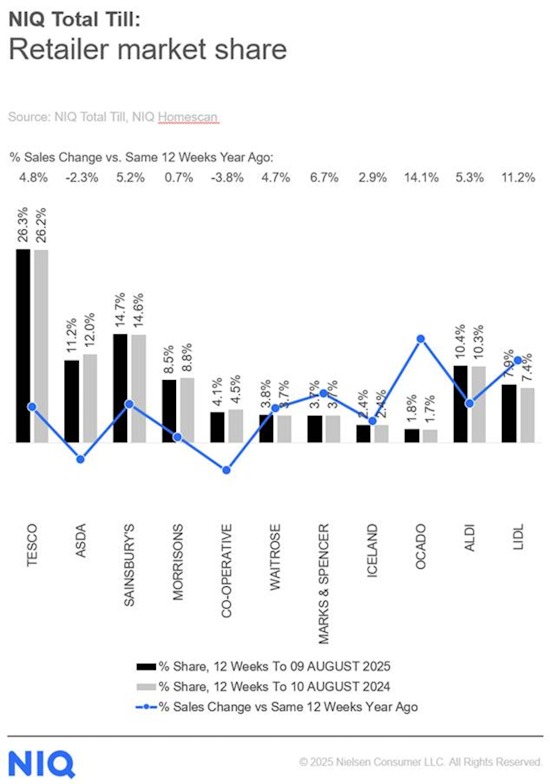

In terms of retailer performance, Ocado (+14.1%) continued to outperform both stores and online channels. Lidl (+11.2%) saw a strong increase in new shoppers with almost one in two households (49%) shopping at the discounter over the last twelve weeks.

Meanwhile, Marks & Spencer’s food business recorded a 6.7% increase, up from a 4.3% rise in last month’s report, as the impact of the cyber attack in April faded from the figures.

“After the three heatwaves in early summer, this reset was expected and the slowdown in spend was felt across the industry,” commented Mike Watkins, Head of Retailer and Business Insight at NIQ.

“The exception being the discounter channel, where growth was more buoyant at 6.6%. The convenience channel was particularly impacted, with sales down 1.1%, as was the online grocery channel at -2.2%.”

He added: “The start of peak summer holidays also disrupted shopping habits more than usual as the uptick in food inflation would have given many shoppers a reason to delay some non-essential spending for a few weeks. However, with shoppers looking to dine in at home in the summer, this often means more alfresco with barbeques replacing some meals out or ordered in. Supermarkets will be optimistic about a strong end to summer 2025.”

NAM Implications:

- Shoppers continue to shop around for value.

- More savvy spending.

- Increased caution in the face of actual and perceived increases in inflation.

- With more deterrents anticipated in the Autumn Budget.

- A time when growth comes at the expense of rivals.

- Time for a realistic assessment and efforts to optimise any hint of competitive edge…