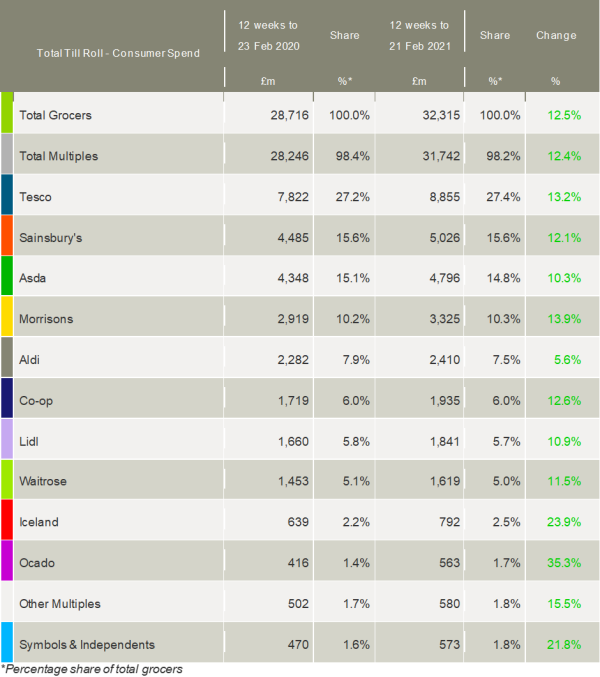

The latest figures from Kantar show take-home grocery sales rose by 12.5% during the 12 weeks to 21 February, with the Big Four supermarket multiples outperforming the discounters. Sales were even stronger over the past month, increasing by 15.1%, the fastest rate of growth since June 2020 as the lockdown restrictions continued to curtail spending in the hospitality sector.

Kantar highlighted that consumers have now eaten an extra seven billion meals at home since spring 2020 and overall shoppers have spent £15.2bn more on groceries during the pandemic.

Looking at the latest month, online grocery sales reached a new record share, accounting for 15.4% of sales, up from 8.7% last year. Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Nearly a quarter of households bought groceries online during the past month, making the most of home deliveries especially to get hold of bulkier goods like canned foods, breakfast cereals and soft drinks.

“It’s been an extraordinary twelve months for online and three million tonnes of food alone have been delivered to people’s homes over the past year. It’s a habit that seems to be sticking among British consumers and internet orders now make up an average of 65% of grocery spending each month for people who do shop online.”

Ocado boosted its sales by 35.3% over the 12 week period with its market share up 0.3 percentage points to 1.7%. Data suggests that the online grocer is increasing in popularity outside of its London heartland and is experiencing the greatest sales growth in the south and midlands of England.

Tesco had a strong month and grew its market share by 0.2 percentage points to 27.4%, marking the retailer’s first gain since December 2016 after its sales rose by 13.2%. The grocer’s success was felt across the business with online sales, larger supermarkets and smaller convenience outlets all contributing to its robust performance.

Iceland maintained its strong run with market share increasing by 0.3 percentage points to 2.5% after its sales surged up 23.9%. The size of the average Iceland basket grew by more than half to £19.93 compared with the same time last year, the fastest rate of increase among all the retailers. Kantar said that Iceland’s fresh and chilled aisles put in a standout performance, supporting the core frozen food lines that make up 39% of its total sales.

Morrisons also continued to perform well and won market share, taking an extra 0.1 percentage points to reach 10.3% of the market, with sales up by 13.9%. Sainsbury’s increased sales by 12.1% to hold its share at 15.6%.

Returning to double-digit growth, Asda sales were 10.3% higher compared with a year ago, while Co-op grew sales by 12.6% to maintain a 6.0% share of the market. Waitrose sales rose by 11.5%.

Meanwhile, growth slowed at Lidl (+10.9%) compared to recent months, whilst fellow discounter Aldi continued its poor run with its market share slipping from 7.9% last year to 7.5% after sales increased by only 5.6%.

With the vaccine roll-out underway and a roadmap out of lockdown on the table, the year ahead is expected to bring a significant shift away from current shopping habits. Kantar suggested that many families will be looking to life post-pandemic and will be keen to hear how tomorrow’s budget might impact their household accounts.

McKevitt said: “In terms of the grocery market itself, we’ll start to see year-on-year decline following the anniversary of the first national lockdown next month. Sales will be measured against last year’s record spending and comparisons will be tough against the heights of 2020.

“Demand for groceries is also likely to subside as the hospitality sector re-opens. The more typical sales patterns of 2019 will come to the fore as the most important metric to gauge retailer performance as we emerge from lockdown over the coming months.”

Meanwhile, Kantar’s data shows that grocery inflation now stands at 1.2% with prices rising fastest in categories such as colas, chilled fruit juices and skincare while falling in vegetables, fresh bacon and fresh beef.

NAM Implications:

- Key is checking how your sales compared, by retailer.

- BTW, the fact that customers have eaten an extra seven billion meals at home since spring 2020…

- …could herald the emergence of the super-savvy diner in hospitality?

- Watch this space…