Industry executives and market analysts have confirmed that supermarket chains have seen a significant downturn in sales over the last couple of weeks following an easing of stockpiling and the introduction of stringent social distancing measures in stores.

At the start of the coronavirus outbreak, total sales at some supermarkets increased by almost 50% with even bigger gains in some categories.

Senior industry sources quoted by the Mail on Sunday said sales at the likes of Tesco, Sainsbury’s, Asda and Morrisons fell last week by as much as 10% compared with the run-up to Easter last year.

One unnamed director said: “There has been a shocking turnaround. Social distancing measures have been crippling stores compared to the gigantic sales increases over the previous weeks.”

With all the major chains restricting the number of shoppers allowed in their stores at any one time as part of the social distancing measures, queues have been forming outside some supermarkets at peak hours. This is said to have prompted some shoppers to top up in smaller shops and convenience stores.

Another grocery source said: “It’s volatile and it’s going to be difficult to see through this, predict behaviour and plan accordingly over the coming weeks as guidelines change.”

Latest industry data released by Nielsen shows UK consumers spent an additional £83m on groceries over the seven days ending 4 April compared to the previous week, but sales were down by 2.6% compared to the same period in 2019. This followed a 12.2% week-on-week decline in the period to 28 March.

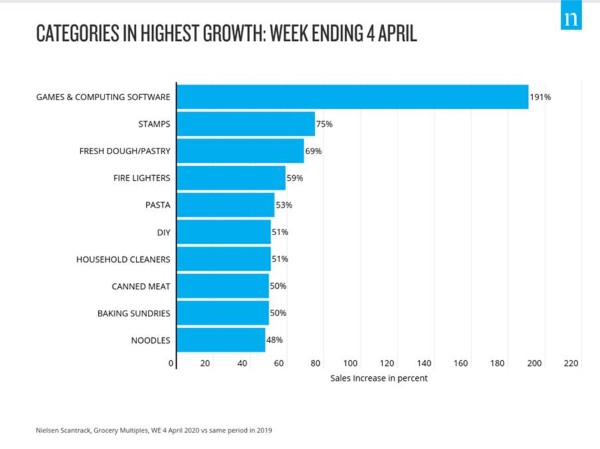

Bucking the trend in the week ending 4 April, sales of baking ingredients such as fresh dough and pastry (69%), and home baking sundries such as cake, cookie and brownie mixes, flour and dried fruit (50%) soared.

Some other popular ‘stockpiling’ categories also continued to be in high demand, with sales of ambient groceries increasing 23% and frozen food up 17%. Meanwhile, sales of beer, wine and spirits increased by 15% compared to the same time last year, as pubs and bars remained shut across the UK.

Nielsen’s data also showed that shoppers are now starting to purchase more items related to entertainment and other activities, with sales of games and computer software up almost 191% versus the same week last year. Moreover, sales of DIY accessories that can be purchased at some supermarkets, such as paint, wallpaper and tools, surged by 51%, as consumers turn their hands to DIY.

Mike Watkins, Head of Retailer and Business Insight at Nielsen, said: “With restricted living now the new norm in the UK, the lockdown has also brought a new shopping experience for many consumers. Sales have started to slow, and this can be attributed to the many social distancing measures, such as queues outside, routes through the store, and people shopping alone – reducing the impulse buys ‘pester power’ encourages. This has meant that weekly shops are now more planned. Shoppers want to get in and out as quickly as possible, with less time spent browsing. Availability is also still a challenge as the supply chain continues to play catch up in some areas.”

Watkins added: “With 56% of UK shoppers believing that the impact of COVID-19 will continue for four to 12 months, weekly sales and shopper behaviour will remain very unpredictable for some time. We can expect this pattern to continue for at least the next three to four weeks, and then start to stabilise when the country begins to slowly recover from the lockdown situation.”

NAM Implications:

- My Sunday morning paper & beer run to Tesco morphed into a local convenience-shop trip…

- …on witnessing the Tesco queue snaking around the car park.

- End of the top-up shop at Tesco?