Latest data from NielsenIQ (NIQ) shows Total Till sales growth in UK supermarkets slowed to 4.0% during the four weeks to 22nd February, down from the 5.3% figure recorded in January.

After a slow start to the month, the grocery multiples saw stronger growth in the week leading up to Valentine’s Day, driven by increased shopper visits (+5.9%). Retailers embraced the occasion, with promotional spend contributing 24% of sales, supported by investment in price cuts and Dine-In offers. While in-store sales benefited the most (+4.3%), online sales growth remained muted at +0.7%, with market share declining to 12.9% from 13.3% a year ago.

Shoppers took advantage of the promotions with Valentine’s food (excluding drinks) seeing value growth of 5.1% and units growing at 0.6% driven by cakes and morning goods. £962m was spent across Valentine’s Day on food and gifting with shoppers spending £100m on cut flowers (+6.6%), while toiletries gift packs saw a significant rise to £5.8m (+27%) and fragrances to £19m (+11%). There was also increased spend (+ 4.2%) on impulse/confectionery.

The NIQ data also reveal notable growth in dine-at-home meal options, with shoppers spending £137m on fresh ready meals (+2.9%). Champagne sales reached nearly £11m (+5.7%), while sparkling wine saw a significant boost, with spending climbing to £38m. However, despite the purchasing of sparkling wine, sales declined by 3% compared to last year.

Over the four weeks, meat, fish and poultry was the fastest growing super-category (+8.5%) followed by dairy (+6.4%) and produce (+5.7%) as fresh foods were favoured over packaged grocery (+2.4%) and frozen food growth was weaker (+0.7% and -0.6% units). Beer, wine and spirits remained in decline (-2% and -2.8% in units).

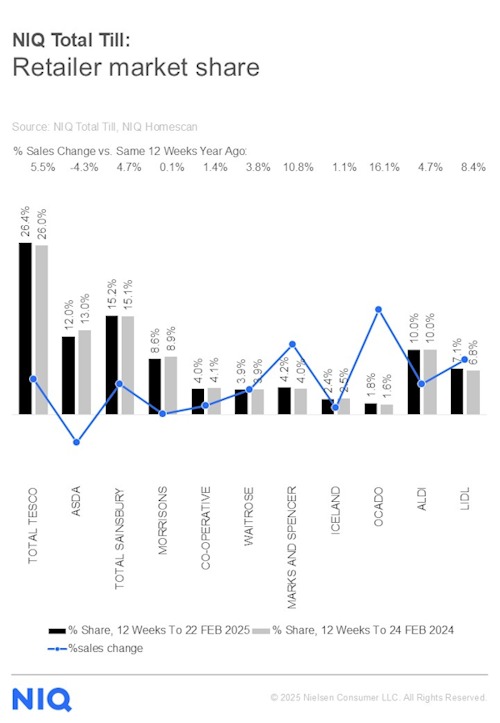

In terms of retailer performance, Tesco continued its strong run (+5.5%), with Sainsbury’s (+4.7%) close behind. Waitrose’s growth improved (+3.8%) with an increase in shoppers compared to a year ago.

Dine-in deals for Valentine’s Day helped drive sales at M&S (+10.8%), with almost one in four shoppers visiting its stores in the last four weeks. Aldi continued to improve sales (+4.7%) with Lidl (+8.4%) and Ocado remaining the fastest-growing retailers (+16.1%).

Mike Watkins, Head of Retailer and Business Insight at NIQ, commented: “Retailers capitalised on the opportunities around Valentine’s Day as shoppers wanted to create a special occasion at home. With the pinch of the cost of living, many shoppers dined in to save money this year, with premium food options growing and themed meals and gifts very much in vogue for treating loved ones.”

He added: “There are three things to consider looking ahead. Firstly, the GfK Consumer Confidence Index for February suggested that people don’t expect the economy to show any dramatic signs of improvement and with many household bills, such as energy, water and council tax, increasing over the next few weeks, shoppers will be looking carefully at their discretionary spend.

“Secondly, the recent sales trends in Hospitality from CGA show some weakness. Finally, the increase in food inflation reported by BRC NIQ this week looks to be a turning point. The overall impact will be that many shoppers will need to seek out more discounts when shopping, in particular from supermarket loyalty schemes – maybe switching some food and drink away from out-of-home to supermarkets.”

NAM Implications:

- UK retail remains challenging…

- …with consumer uncertainty and lack of confidence causing shopping around for value.

- And seeking items on promotion.

- With more Autumn Budget driven cost increases yet to emerge…

- …there seems little prospect of improvement.