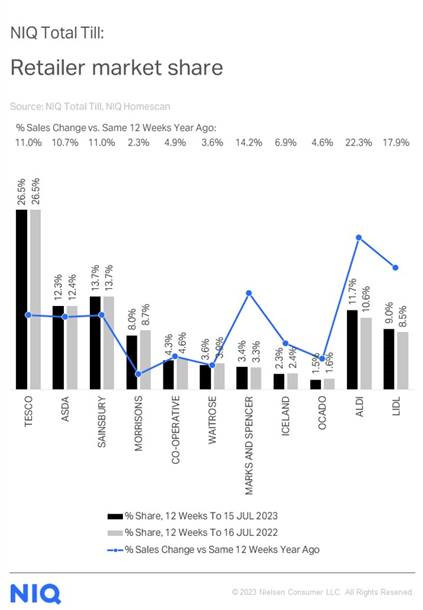

Growth in total till sales at supermarkets in the UK slowed to 8.9% over the four weeks ending 15 July, down from an unusually high figure of 12.4% the previous month, which was boosted by good weather and surging prices.

The data from NIQ (previously known as NielsenIQ) suggests the slowdown was also the result of weaker food inflation and trading against previous high comparatives, which included the acceleration of inflation this time last year.

Volume sales at the grocery multiples also weakened, down 3.6% compared to a fall of 2% in June, as shoppers sought to re-adjust spend ahead of their summer holidays. NIQ noted that this was also aided by the cooler and wetter weather during the w/e 14 July, which led to less occasions for shoppers to socialise and spend on additional items compared to the start of last year’s heatwaves. As a result, July was the first time shoppers spent less than a prior period since the seasonal lull in January and last September, which was after the summer heatwaves.

In terms of category performance, growth slowed for dairy products (+9.4%) and frozen foods (+7%) amidst retailer price cuts. However, there was an increase in sales of confectionery (+16.5%), packaged grocery (+13.4%) and crisps and snacks (+12.8%), with confectionery sales seeing the fastest growth.

The data from NIQ confirms that as more retailers reduce prices to attract cash-strapped shoppers, promotional activity is gaining momentum and now accounts for 22.5% of grocery sales, up from 20% in the same period last year. This is the highest level in the past 12 months, except for at Christmas and Easter.

Bargain hunting among shoppers maintained the gap between in-store sales (+9.4%) and online (+4.3%) as shoppers spent £800m more in store than this time last year. This has helped the discounters maintain their strong growth, with sales increasing 22.3% at Aldi and 17.9% at Lidl as both retailers attracted more shoppers. They are also selling more fresh food than a year ago, and these categories accounted for over half of the incremental sales growth at the discounters in the last four weeks.

As consumers seek out more ways to reduce their grocery bills, NIQ’s data also shows a growing demand in value retail chains, such as B&M, Home Bargains and Poundland, where FMCG sales increased by 11%. Research shows that 70% of households have visited these chains over the last year, with 73% shoppers seeking lower prices and 45% for household products.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commented: “As shoppers continue to seek out value by looking for bargains, we’re seeing them become more channel agnostic and less likely to remain loyal to many supermarkets. The value retail channel is becoming a destination for many consumers for snacks, household, and personal care, as well as certain branded packaged grocery items.”

He concluded: “Over the next eight weeks, we expect to see a similar pattern on spending with little improvement in volume sales as school holidays kick off. The battleground for shopper loyalty is now shifting – retailers must be prepared to build on the trend to shop little and more often when consumers revert to their usual shopping patterns post holidays.”

NAM Implications:

- Standout points have to be Aldi & Lidl each greater than Morrisons grocery share.

- And a combined share of 20.7%, second only to Tesco…

- With both discounters growing at 22.3% at Aldi and 17.9% at Lidl.

- As shoppers become less retailer loyal and shop around for economies…