The supermarket sector has recorded its first overall decline in sales since June 2016 after struggling to match last year’s record trading that was driven by hot weather and the football World Cup. However, whilst all the Big Four supermarkets saw a drop-off in performance, the discounters continued to grow and grab market share.

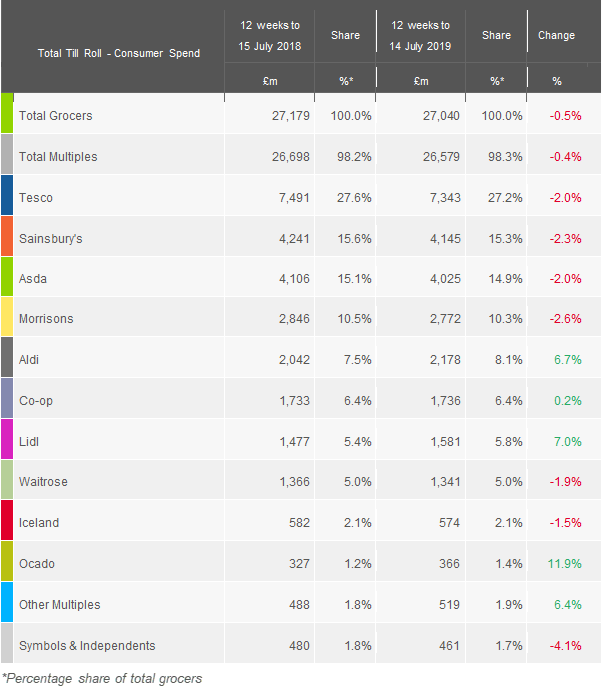

The grocery market share data from Kantar showed year-on-year supermarket sales fell by 0.5% in the 12 weeks to 14 July 2019 as demand in traditional summer categories such as alcohol and ice cream weakened.

Whilst it is anticipated that the market will return to growth once the comparative highs of the 2018 summer pass, Fraser McKevitt, head of retail and consumer insight at Kantar, highlighted that the main factor behind the recent sales drop-off was shoppers heading out to stores less often. “Last year people shopped more frequently and closer to home as they topped up the cupboards while enjoying the sunshine and the men’s football World Cup. This year households are making one fewer trip, which may not sound like much but is enough to tip the market into decline,” he said.

“In addition, like-for-like grocery inflation fell marginally to 0.9%, which is good news for consumers but has made it harder for retailers to achieve value growth.”

Lidl was the fastest growing bricks & mortar retailer in the latest period, with its sales up 7%. McKevitt commented: “Lidl increased alcohol sales by 19%, bucking the market trend partially thanks to its deal offering 25% off when buying six bottles of wine, reflecting efforts the retailer is making to encourage shoppers to purchase by the trolley not the basket. This focus is also evident through its newspaper vouchering deals, which offer a discount when people spend £20 or more.”

Aldi reached a new record share of the market, accounting for 8.1% of sales with spend up by 6.7% on last year. Its branded lines were said to have grown particularly quickly, up 17%, although they still account for less than a tenth of the discounter’s overall sales.

Meanwhile, sales at the Big Four grocers fell collectively by 2.1%. Asda’s performance faced a particularly hard comparison against last summer, when sales were growing at their fastest rate in more than six years. However, whilst its overall sales were down 2%, the retailer did increase spend among more affluent ‘AB’ shoppers and achieved double-digit online sales growth.

Tesco continued to lose market share, down 0.4 percentage points year-on-year to 27.2%. Despite this, Kantar highlighted that the chain did find success through its value own label ranges, including both its ‘Farm Brands’ and ‘Exclusively at Tesco’ lines, which increased by 11%.

Sainsbury’s sales slipped 2.3% this period, corresponding to a dip in its market share of 0.3 percentage points to 15.3%. While frequency of customer visits did fall, the UK’s second largest retailer also attracted 254,000 additional shoppers through its doors.

At the same time, sales at Morrisons fell by 2.6% taking its market share down to 10.3%, a loss of 0.2 percentage points. McKevitt commented: “Morrisons continues to sell more on promotion than any other retailer. Currently 47% of spend through the tills is linked to a deal, and this proportion is still increasing in contrast to many of its rivals. In addition, confectionery sales at Morrisons outperformed the already buoyant market.”

Amid the market slowdown, the Co-op kept its run of growth going. The retailer has now seen sales increase consistently since May last year. McKevitt said: “Growth of 0.2% may sound modest, but it is particularly impressive considering it comes on top of a record increase of 6.4% last year. Co-op’s popular beer and pizza deal, which offered a full night in for only £5, sold well in 2018 and has now returned to the shelves – the retailer will be hoping this eventually translates to additional market share, which remained flat this period at 6.4%.”

Meanwhile, Ocado was the standout retailer this period in terms of growth, increasing sales by 11.9% and growing its shopper base by 6% over the past year. The online retailer’s business model was said to have shielded it from the effects of shoppers cutting back on unplanned and smaller trips, which has impacted the bricks & mortar retailers, and Ocado’s customers are actually buying online more frequently than last year.

NAM Implications:

- Key issue is the extent to which these changes in market share are ‘permanent’.

- In other words, if the mults cannot return to former glory…

- …where does that leave supplier organisation structures that were geared to 80%+…?