New data released by NielsenIQ confirms that shoppers in the UK reined in their grocery spending post-Christmas, with supermarkets suffering a further decline in sales volumes.

Total Till grocery sales rose by 7.6% in the four-week period to 28 January, driven by another increase in food price inflation, which reached a new high of 13.8%. However, sales volumes slid 6.9%, the biggest fall in over nine months, as shoppers faced more cost of living increases.

NielsenIQ noted that supermarkets experienced a “very slow” first week of January due to the bank holidays, although weekly value growth improved to 6.0% at the end of the month as many shoppers had their first monthly payday of the year.

However, the data suggests that many shoppers tried to save money and focussed on essentials, with bakery (+12.6%), dairy (+11.5%), pet food/care (+10.4%) and frozen sales (+8.9%) all experiencing an increase in value sales. However, fresh produce value sales fell 3.6%, while value sales for beers, wines and spirits (BWS) declined 4.7% (with volumes -8.5%). Volume sales for meat and poultry also fell 10.2%.

NielsenIQ highlighted that sales were strongest in bricks & mortar stores (+9.4%), with online grocery sales falling 8.7%. The online share of all FMCG sales remained at around 11.1% – similar to the underlying share in the latter part of 2022.

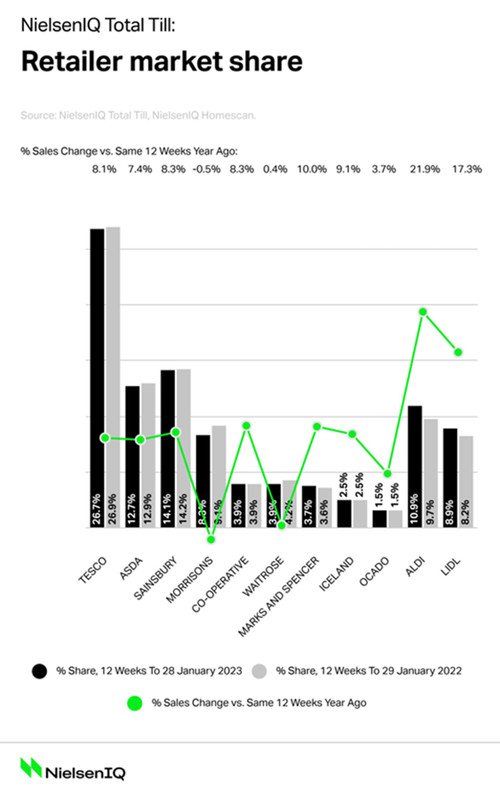

In terms of retailer performance (see below), Aldi and Lidl continued to show strong momentum, with year-on-year sales growth of around 20%, whilst Morrisons and Waitrose remained the worst performers.

Meanwhile, NielsenIQ pointed to its latest consumer survey data that showed that 72% of UK households fear they will be severely or moderately affected by the cost of living crisis in the first part of 2023, up from 54% at the end of last year.

“We expect a challenging first quarter for the grocery industry, with inflation very much top of mind for shoppers. As a result, shoppers will continue to trade down to cheaper brands or private label products,” said Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight.

In January, the data shows that private label sales in the Household category grew by 16.5%, Ambient Grocery increased 16.8%, and Frozen rose by 20.2%.

Watkins added: “When consumers are cash poor, they also shop more frequently and across more retailers, because they can only afford to shop for groceries ‘little and more often’ to help manage household budgets. This will probably continue until Easter, when family gatherings and hopefully better weather gives a boost to sales.”

NAM Implications:

- Bricks & mortar stores a clear beneficiary of whatever volume was available.

- But even clearer undertones of more inflation-trouble ahead…

- However, Aldi and Lidl YoY 20% growth and Morrisons & Waitrose worst-in-class…

- ..speaks for itself.

- Whilst the trade down to cheaper brands and O/L continues…

- …The key issue is how long these conditions will last.

- (anyone anticipating improvements by mid-2023 had better have good reasons for being outside mainstream thinking…)