Data released by Nielsen confirms there was only a slight uptick in grocery sales heading into Lockdown 2. However, despite uncertainty around Christmas gatherings, supermarkets look set to see record sales over the festive period.

Nielsen’s research showed that supermarket sales rose 6.9% in the four weeks to 31 October, with growth only rising to 7.2% in the final week of the period.

Over the four week period, shoppers spent an average of £17.70 per basket on FMCG at stores and online, which is 20% more than the same time last year. However, the number of store visits continued to remain low, down 12% compared to the same period last year as consumers continued to limit unnecessary travel and visits to stores, instead turning to online which continues to grow, with sales up 87%.

Beers, wines and spirits (+15%), frozen food (+16%) and packaged grocery (+11%) remained the fastest-growing categories over the four week period.

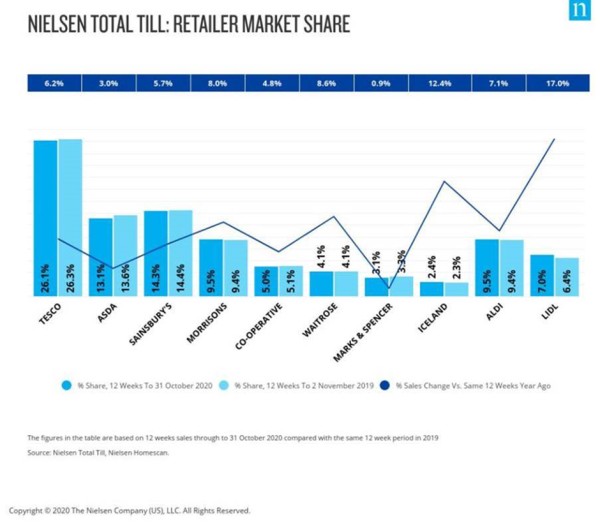

In terms of retailer performance over the last 12 weeks ending 31 October, Lidl continued to experience strong growth (+17%) following the launch of its Plus loyalty app. Waitrose (+8.6%) was helped by its increased capacity for online sales. Morrisons (+8%) remained the fastest-growing supermarket out of the Big Four, and sales at Tesco (+6.2%) increased ahead of Sainsbury (+5.7%) and Asda (+3%).

Nielsen highlighted that the recent lockdown measures and uncertainty means consumers are unable to plan ahead for Christmas and family occasions during the holidays. However, it is estimated that shoppers will spend £2bn more in supermarkets for the full quarter up to 26 December 2020, an all-time record high, and an expected sales growth of 7%.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, commented: “We can see that supermarket sales have experienced moderate growth over the last four weeks, growing a little in the final week in anticipation of another lockdown.

“However, UK shoppers’ plans for the Christmas period remain in limbo – they are unable to plan when and where they will shop, how much they will spend and of course whether they will be able to spend it with family and friends. Assuming that restrictions on travel and get-togethers are relaxed in December, food and drink retailers should then see pent up demand translated into extra purchasing for the festive season.”

12-weekly % share of grocery market spend by retailer

and value sales % change

NAM Implications:

- Key is how your anticipated sales compare…

- Especially online, with sales already up 87%.

- Meanwhile, the uncertainty of Christmas looms over everything.

- Suppliers need to place some bets, or suffer the consequences.

- i.e. anticipating little or no clarity from the government.