Latest figures from Kantar show grocery price inflation fell to 3.2% over the four weeks to 14 April – the fourteenth consecutive monthly drop. The decline was aided by a significant increase in promotional spending, with items bought on offer making up 29.3% of supermarket sales – the highest level outside of Christmas since June 2021. Overall, take-home grocery sales rose by 3.3%.

“We’ve been monitoring steady annual growth in promotions over the past 11 months as retailers respond to consumers’ desire for value,” said Fraser McKevitt, head of retail and consumer insight at Worldpanel by Kantar.

“Deals helped shoppers save a massive £1.3bn in the latest four weeks, almost £46 per household. This emphasis on offers, coupled with falling prices in some categories like toilet tissues, butter and milk, has helped to bring the rate of grocery inflation down for shoppers at the till.”

The data shows that the early Easter didn’t dent seasonal sales, with spending on confectionery topping £100m for the first time ever in the seven days up to and including Easter Sunday. This was driven by both higher prices and a 3% increase in the number of chocolate eggs sold.

“The growth in confectionery also reflects a broader trend towards snacking in British diets,” said McKevitt. “Over the past decade, there’s been an increase in almost all types of snacks. Consumers munched on chocolate confectionery 93 million more times in the year to June 2023 than in the twelve months to June 2013. Fruit has also bumped up the list of Britain’s snack choices – 314 million more pieces of fruit were eaten between meals in 2023 than in 2013.”

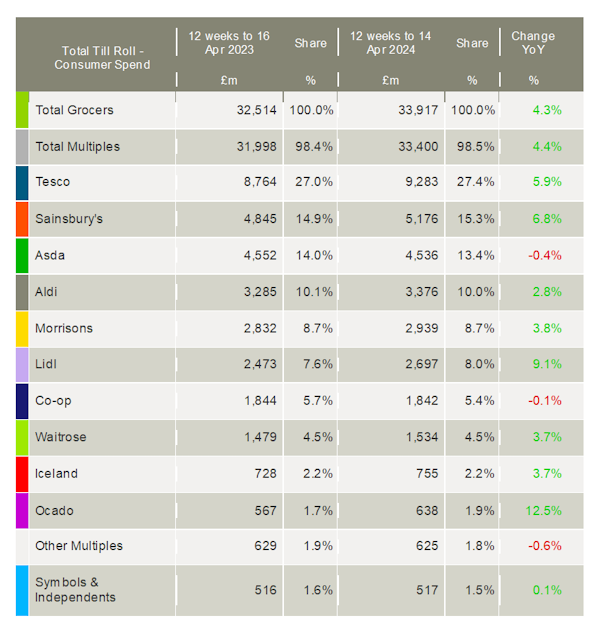

Ocado was again the fastest-growing grocer this month, improving sales by 12.5% in the 12 weeks to 14 April, ahead of the total online market, which grew by 6.8%. The online retailer accounted for 1.9% of take-home grocery sales, up from the 1.7% it held a year ago. Meanwhile, the total online grocery channel reached a share of 12.0% for the first time since July 2022.

Market leaders Tesco and Sainsbury’s both gained 0.4 percentage points of share in the latest period, holding 27.4% and 15.3% of the market respectively. Sainsbury’s sales increased by 6.8% and Tesco grew by 5.9%.

Asda continued to struggle, with its share slipping from 14.0% to 13.4% after recording a 0.4% fall in sales.

Morrisons held on to its share of the market at 8.7%, the best share performance for the retailer since 2021, with spending through its tills up by 3.8%.

Lidl achieved a record 8.0% share of the market, up by 0.4 percentage points versus a year ago, fuelled by sales growth of 9.1%. Despite its sales increasing by only 2.8%, Aldi reclaimed the 10.0% market share it last held in September 2023.

NAM Implications:

- Standout has to be a combined Aldi & Lidl share of 18% and growing.

- Asda needs to show it is in it for the long haul.

- While Morrisons and Asda’s debt means regaining share via price cuts is difficult.

- Suppliers might consider a ‘what if’ re the UK big 4 becoming Tesco, Sainsbury’s, Aldi and Lidl?