Latest data from Kantar shows that take-home grocery sales in the UK rose by 2.5% over the four weeks to 1st December as shoppers prepared for Christmas, with the total figure for this month expected to exceed £13bn for the first time.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Monday 23rd December is likely to be the single busiest day for the supermarkets this year, although there are clear signs that shoppers are already stocking up their cupboards. Sales of assorted sweet biscuits and biscuits for cheese both doubled in November compared with the month before, while 8% of us bought a Christmas pudding.

“Many of us take the chance to treat ourselves at this time of year, and retailers are rolling out seasonal product lines to help us celebrate in style. The proportion of spending on premium own-label products reached 5% over the latest four weeks, and we expect it to climb even higher in December to nearly 7%.”

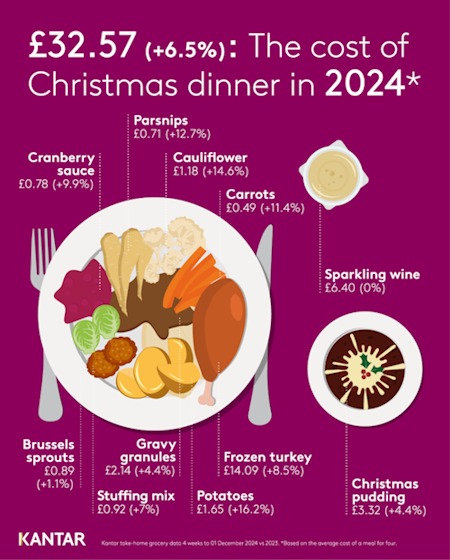

Meanwhile, the Kantar data shows that the cost of an average Christmas dinner this year for four people has risen to £32.57, up by 6.5%, largely driven by higher prices of turkey and Christmas vegetable staples.

Wider grocery price inflation remained relatively stable over the last month at 2.6%, with grocers prioritising low pricing over multibuys.

McKevitt said: “Sales on promotion reached 30% in November, the highest since Christmas last year. It’s retailer price cuts, often accessed through loyalty cards, that are really driving this. While multibuy promotions have stayed flat, spending on price cut offers has grown by 14%, worth £355m more than last year. Shoppers are grabbing the chance to spend that little bit more than usual on Christmas specials, and champagne, wine and spirits saw the biggest levels of buying on deal.”

Looking at the performance of individual retailers, Tesco achieved its highest market share since December 2017 at 28.1%, up from 27.4% in 2023, after its sales grew by 5.2% in the 12 weeks ending 1st December. Sainsbury’s share increased by 0.3 percentage points to 15.9%, and spending through its tills was 4.7% higher than last year. Kantar noted that the UK’s two biggest grocers now have a combined market share of 44%.

Ocado’s sales rose by 8.7% over the period, outpacing the total online market, which grew by 3.6%, with shoppers spending £4.2bn in the channel overall across the 12 weeks.

Lidl was again the fastest-growing bricks & mortar grocer, with sales up by 6.6% and its share hitting 7.7%. The discounter’s footfall was up by nearly 10% in comparison with a year ago.

Spending at Aldi grew by 2.1%, with its market share holding steady at 10.3%.

Sales at Morrisons rose by 2.0%, with its average transaction value up 4.8%, helped by strong online performance. This was significantly ahead of the average growth in basket spend across the grocers as a whole, which edged 0.7% higher to £24.51.

It was another disappointing period for Asda, with its market share sliding to 12.3% after a 5.6% fall in sales.

Waitrose grew slightly ahead of the market, with spending increasing by 2.6% and its market share holding steady at 4.4%.

Meanwhile, Kantar provided some insight into the performance of M&S, whose higher proportion of clothing and general merchandise in its sales mix means it does not fall under the definition of ‘grocers’ using the research group’s Till Roll methodology. For this reason, a comparable market share number is not provided for M&S.

McKevitt said: “The number of different retailers we visit in the run-up to Christmas is higher than at other times during the year, including wider high street brands like M&S. Just under one in three households, at 32%, bought food, drink and other groceries to have at home from M&S during the 12 weeks to 1 December and looking at grocery sales alone, spending at M&S rose by 10.4%.” (The growth number is for FMCG sales only, while the figures for grocers in the market share table below cover total spending through supermarkets’ tills).

NAM Implications:

- Tesco’s increasing momentum continues to impress and challenge weaker rivals.

- Asda’s continuing sales weakness puts further pressure on the retailer to improve store performance, fast.

- Despite Aldi lagging in growth rate…

- …the combined 18% share of Aldi & Lidl has to continue to be a concern to the mults.

- Given the improving grocery performance of M&S…

- …it appears that Kantar will need to find a way of adding M&S grocery sales to their market share analyses.