Latest grocery market share data from Kantar shows that sales growth in the sector has accelerated in recent weeks with lockdown trends such as shopping more online and in convenience stores continuing. However, there are also signs that the market has started to edge back towards normality with trips to supermarkets rising and sales of outdoor food increasing.

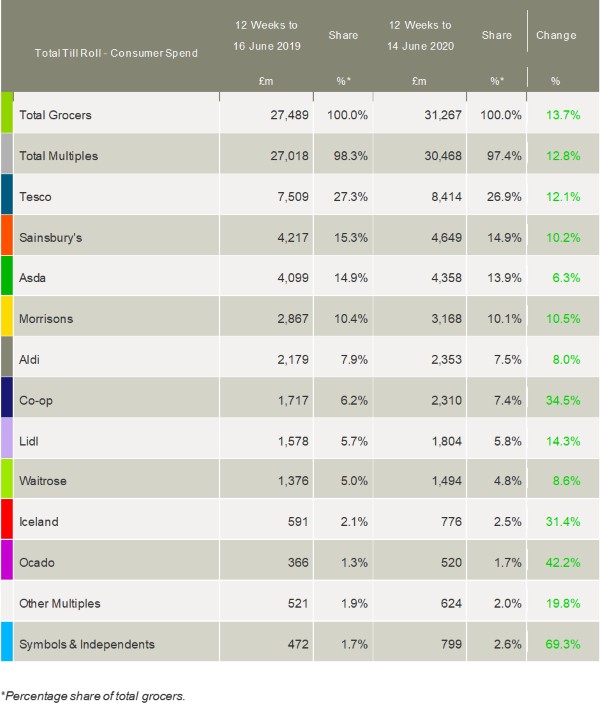

Total take-home sales across all grocers increased by 13.7% year-on-year over the 12 weeks to 14 June, covering the full lockdown period. Shorter-term, the latest four-week period saw sales growth accelerate to 18.9%, up from 17.2% the previous month, with shopping patterns still disrupted compared with more normal times.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “The boost has been led by online sales, which have continued to accelerate, and convenience stores, which took £1.6bn through their tills during this period. Despite the jump, grocers are still navigating a steep drop in the amount of food and drink bought on the go, which was down by a third in early June. These numbers are not covered in today’s take-home sales data, but were worth £347m to grocers in June last year and so represent a considerable shortfall.”

Online grocery’s strong performance continued this month, with sales increasing by a whopping 91% over the four weeks. The big increase in available delivery slots across the sector meant nearly one in five British households bought over the internet in the month to mid-June, totalling 5.7 million shoppers. The cumulative impact of lockdown has helped Ocado to achieve its highest ever market share – hitting 1.7% over the past 12 weeks thanks to an industry-high sales growth of 42.2%.

Meanwhile, the data reaffirms that convenience stores have become an increasingly important outlet for shoppers during the lockdown – be they independent retailers, which are growing at 69.3%, or the smaller formats of major outlets such as Tesco Express and Sainsbury’s Local.

Kantar highlighted that convenience stores accounted for 14.7% of all sales in the past four weeks. This is still considerably higher than normal levels, but it has receded from April’s peak of 16.3%. The Co-op has seen strong sales as a result, with its network of local stores helping to accelerate its growth to 34.5% over the 12 week period. The society’s market share also hit 7.4%, its highest figure since March 2001.

While many of the major trends of the coronavirus period continued into June, the relaxing of lockdown rules is starting to ease the market back towards pre-pandemic shopping patterns. McKevitt explained: “We’re still shopping less frequently but shoppers are gradually changing their behaviour. Households made 77 million fewer trips to the grocers in the latest four weeks compared with last year, but that’s still 19 million more than in May, reflecting the slight easing of government restrictions. Once in the shops, customers are continuing to buy more than usual, spending 42% more per trip than in June last year at £26.37 on average.”

As pubs and restaurants remained closed, alcohol sales through the grocers continued to boom, growing 43% in the past four weeks. Elsewhere, good weather and shoppers getting the green light to meet friends and family outside their household meant picnic favourites were in high demand. Kantar’s data showed sales of soft drinks and chilled dips increased by 28% and 30% respectively. There were also signs of British consumers making the most of early summer – as ice cream sales rose by 57%, burgers by 44%, and sausages by 40%.

However, it appears that consumers are also contemplating their domestic budgets. A recent survey by Kantar found that two-thirds of shoppers are “very concerned” about the economic outlook for the rest of 2020. Efforts to tighten purse strings can already be seen in a preference among furloughed workers for budget own label lines and a move away from more premium products.

Meanwhile, looking at other retailers in the sector, Iceland was another star performer with its sales increasing by 31.4% over the 12-week period. McKevitt commented: “There’s plenty to celebrate for Iceland, which turns 50 this year and recently revealed a return to full ownership for Malcolm Walker. The retailer now accounts for 2.5% of the market, matching its highest ever share which was recorded back in June 2000.”

Meanwhile, Tesco led the way amongst the Big 4 with its sales growing by 12.1%, compared to 10.2% at Sainsbury’s. Both retailers were said to be enjoying strong growth in their convenience estates and online operations.

Asda’s sales increased by 6.3%, but its share fell from 14.9% to 13.9%. Morrisons grew sales by 10.5%, with a market share of 10.1%. Waitrose sales rose by 8.6%, giving it a market share of 4.8%.

Lidl’s robust sales growth of 14.3% moved its market share up to 5.8%. However, Aldi continued to underperform with its sales increasing by only 8.0%, resulting in its market share weakening to 7.5%.

Kantar’s data showed that grocery inflation had accelerated to 4.0%, compared with 3.1% last month. Prices were said to be rising fastest in markets such as bacon, sausages and cooked meats while falling in poultry, bread and eggs.

NAM Implications:

- Given that this data covers the entire lockdown period…

- …worth a detailed comparison with your brands/categories and channels.

- Also worth noting the emergence of the super-savvy consumer and attendant caution.

- Finally, benefits in checking for your fair share of individual mults, discounters and online business.