Latest figures from Kantar show that consumer spending on groceries in Ireland is continuing to fall, with shoppers altering their behaviour to combat rising prices.

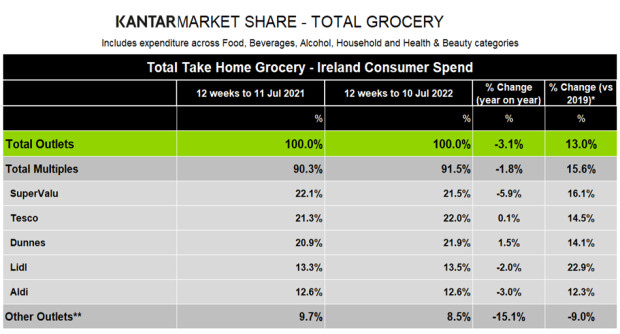

Total take-home grocery sales in the country fell by 3.1% over the 12 weeks to 10 July. However, the decline slowed over the final four weeks of the period, with a drop of 0.9%.

The decline comes against the backdrop of surging grocery inflation which stands at 7.7% – the highest level seen in the country since August 2008. Emer Healy, Senior Retail Analyst at Kantar, commented: “We are seeing rising costs on many fronts, and shoppers’ weekly grocery bill is no exception to the rule. Food and drink prices are continuing to climb, and the impact of this on shopping budgets is now unavoidable for many consumers.”

To manage these rising costs, consumers are turning towards cheaper alternatives and reducing their shopping frequency.

People are now making two less trips to the supermarket on average compared to this time last year.

Meanwhile, branded items are feeling the impact as shoppers turn to retailers’ less expensive own-label offerings. As a result, brands’ share of grocery spend in Ireland has dropped to 47.6%, from 49.6% in 2020, with shoppers spending €72m less on branded goods year-on-year.

Sales of own-label goods grew 1.5% over the last 12 weeks, with shoppers spending €19m more year-on-year. Sales of own-label ranges at Tesco, Dunnes, Lidl and the online retailers were found to have grown by 21.1%, collectively, ahead of the overall own-label market. Own-label now accounts for 46.7% of the Irish grocery market in terms of consumer spend, compared to 44% in 2020. In particular, shoppers appear to be turning towards the value ranges within own-label, with sales jumping 9.7% as shoppers spent €4.8m more year-on-year.

Online grocery sales in July were up 15%, with shoppers spending an additional €6.1m compared to last year. An influx of new online shoppers contributed an additional €4.8m to overall spend. Online sales of own-label goods saw a 21% boost during the month of July, with shoppers spending an additional €10.9m.

Amongst the top three retailers, the landscape has become more competitive as the gap narrows with only 0.1ppt between the top two retailers. Tesco now holds the top spot with a 22% share of total grocery market spend in Ireland, having seen growth of 0.1% in the last 12 weeks after attracting four million additional shoppers.

Dunnes holds a 21.9% share, having grown 1.5% by attracting new shoppers, which contributed an additional €23.2m to its overall sales performance. Lidl, holding 13.5% of the market, also welcomed new shoppers to its stores which contributed an additional €13.6m to its overall performance.

SuperValu, with a 21.5% share, continues to see shoppers returning to its stores more often than any other retailer. Aldi, with a 12.6% share, boosted its shopper base by 1%. Combined with shoppers making more return trips, this contributed an additional €8.6m to its overall performance.

NAM Implications:

- Apart from the anticipated swings to own label and cheaper brands…

- …the standout point has to be that the discounters combined share of 26.1%…

- …is greater than each of the Big 3.

- And Lidl has grown 22.9% vs 2019…