Total till UK grocery sales rebounded to +0.6% over the last four weeks ending 21 May 2022, the first sign of positive growth in 2022 since the Christmas period, according to new data released by NielsenIQ.

Shoppers are ‘shopping around’ for the best prices and NielsenIQ data shows that it is visits to stores (+7% year-on-year) which is driving Total Till growth and the improvement in bricks and mortar sales (+2%).

The overall growth in sales was also helped by a +2.3% increase in the week ending 21 May, as UK shoppers prepared for the school holidays and the long bank holiday Jubilee weekend, with 20% of households expected to buy extra groceries for the Jubilee weekend.

In terms of categories, there was a strong increase in sales for pet and pet care products (+11.9%), soft drinks (+11.2%), and health, beauty & baby care products (+10.4%). The categories with the biggest declines were beers, wines and spirits (-12.1%) due to COVID-19 comparatives, as well as meat, fish and poultry (-4.7%). According to data from NielsenIQ, sales of general merchandise returned to growth with sales in the last four weeks (+0.2%), with sales of clothing at supermarkets up 11%.

Overall, while there was an improvement in grocery sales in the last four weeks, NielsenIQ data shows that shoppers spent 1.2% less at UK supermarkets than in the previous four weeks, down to £10bn. And overall volume sales at the Grocery Multiples fell 6%, also reflecting the squeeze on household budgets.

In the four weeks ending 21 May, NielsenIQ data shows that the convenience channel outperformed supermarkets, with a 3.7% growth in sales, with it now accounting for 24% of all FMCG sales. The increase highlights the change in consumer behaviour, as consumers spend more on the go, at work or socialising and are reverting to shopping ‘little and more often’.

Meanwhile, online sales fell 15% in the four weeks, which it said was a reflection of COVID-19 comparatives in the previous year. The online share of FMCG sales remains stable at 11.7% (compared to 13.7% a year ago and 11.8% in April) and online household penetration is also broadly unchanged at 27% of households. This is now a consistent trend and is an indication that online shopping behaviour has normalised since March.

Promotional spend fell from 21.5% of value sales last month to 20.4%, similar to May 2021 (20.6%), suggesting that there is little appetite from retailers to use volume-based promotions to drive sales when shoppers are looking to spend less on each shopping trip.

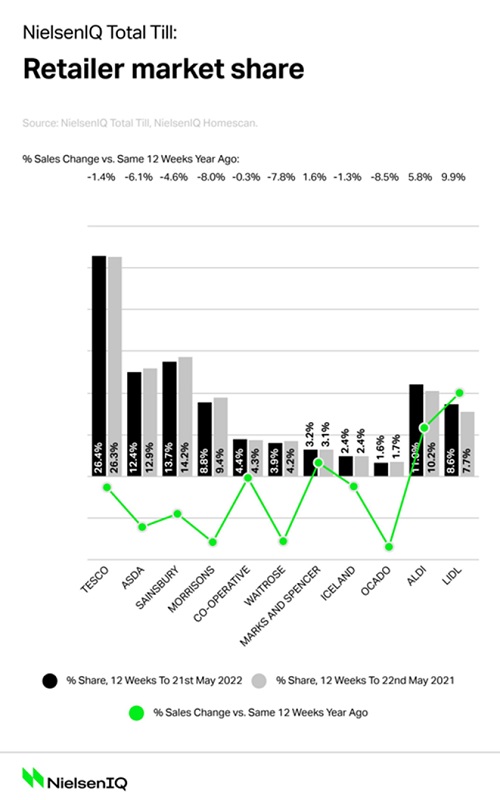

In terms of retailer performance in the last 12 weeks, Total Till sales fell 1.7% with Tesco (-1.4%), Iceland (-1.3%), Co operatives (-0.3%), M&S (+1.6%), Aldi (+5.8%), and Lidl (+9.9%) the retailers to gain market share.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “The forthcoming Platinum Jubilee Bank Holiday weekend should give a welcome if short-term boost to grocery sales. While many shoppers may have been pre-buying items such as drinks and party decorations, the forecasted warm and sunny weather will provide a good trade up opportunity for fresh foods with al fresco dining top of mind for shoppers. While this helps superstores with their breadth of range, convenience stores are also likely to benefit from impulse purchasing as they always do when the sun shines.”

Watkins continued: “Shoppers are becoming more considered in what they buy and the current challenge for supermarkets is to improve volume growth by getting more items into the shopping basket. The upside for supermarkets is that shoppers may be more inclined to dine in at home as budgets get squeezed. Inflation is also moving the dial in the General Merchandise category and with around 35% of General Merchandise sales at supermarkets coming from clothing which has strong value credentials, this may present an opportunity as shoppers return to stores and shop around this summer to save money in discretionary categories.”

NAM Implications:

- Key standouts are Discounter increases in market share.

- And general belt-tightening by cautious, uncertain shoppers.

- Meanwhile, essential that suppliers compare their performances.

- …by retailer and category to check for fair share results vs investment.