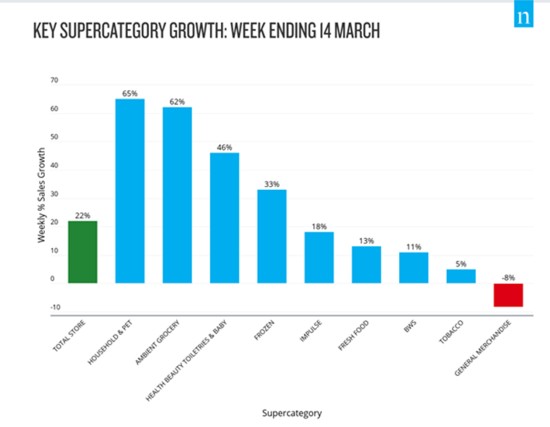

New data released by Nielsen shows grocery sales at UK supermarkets during the week ending 14 March jumped 22% year-on-year. This compared to an 8% increase in the previous week and is equal to additional purchases worth £467m as consumers stocked up amid the coronavirus crisis.

Household and pet care items saw the biggest increase (65%) in sales compared to the same period last year. This was closely followed by ambient groceries, which saw sales increase by 62%, whilst health, beauty, toiletries and babycare items rose by 46%.

There was also a significant increase in sales of frozen food (33%) and for the first time during the coronavirus outbreak sales surged for beer, wine and spirits (11%) as well as impulse snacking items (18%).

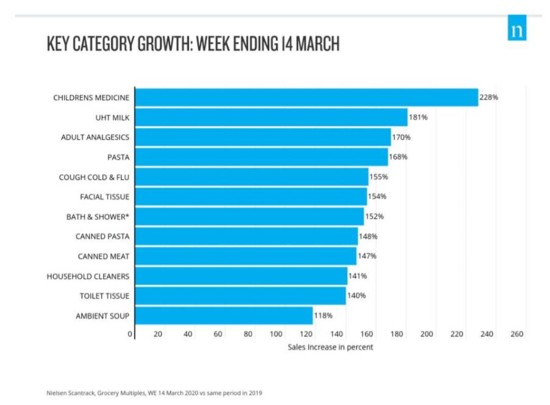

In terms of individual product categories, Nielsen found that there had been further growth in ‘pandemic pantry’ items, as shoppers stocked up on medicine, with sales of children’s medicine growing by 228% versus the same period last week. However, the biggest weekly growth was in UHT milk which increased sales by 181%.

Shoppers have also continued to stockpile toilet tissue (140%) and facial tissues (154%), which experienced significantly faster growth compared to the previous week, despite rationing sanctions implemented by retailers. Other items that saw a surge in sales included pasta (168%), bath and shower items (152%), canned pasta (148%), canned meat (147%), household cleaners (141%), and ambient (canned or packet) soup (118%).

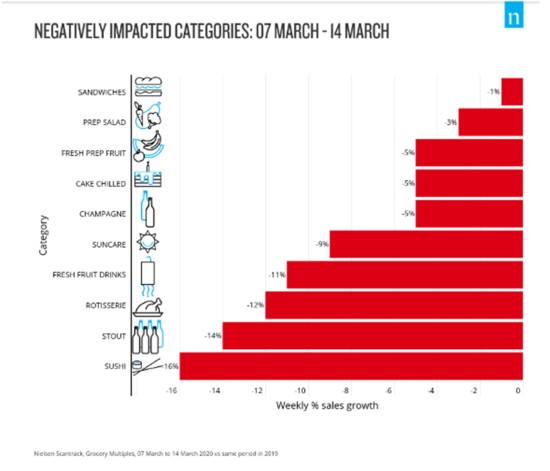

Categories which were negatively impacted include deli and produce items such as sandwiches (-1%), fresh prep fruit (-5%) and salad (-3%), while sushi ranked the worst impacted category overall, seeing weekly sales decline by 16%.

Mike Watkins, Head of Retailer and Business Insight at Nielsen, commented: “The week ending 14 March was the first week we witnessed retailers come under significant pressure to serve consumers, as supply chains were stretched in order to keep up with the unprecedented demand from shoppers.

“The announcement on 20th March that retailers are now allowed to collaborate on supply chain planning, as well as share distribution and logistics, is likely to be a welcome development, as manufacturers, wholesalers and retailers work together to reduce the impact of stockpiling.

“Our data shows that stockpiling has intensified as consumers continuously purchase more of the same items, leading to a noticeable rise in ‘out of stocks’. During this particular week we also saw sales of frozen food accelerate. Shoppers have stocked up their cupboards and now they’re stocking up their freezers. We anticipate we’ll see a further surge in sales as retailers continue to work hard and put various measures in place to keep the shelves full over the next few weeks.”

NAM Implications:

- Stockpiling of non-perishable products means that households will live off stocks as the situation improves.

- Whilst a shortage of money will accelerate this trend.

- Real issue is how ‘normal’ will be defined in order that companies can plan production and allocate resources.

- Time for a fundamental return to basics?

- (with cash the only certainty…)