Latest NielsenIQ data shows total till sales in the UK supermarket sector grew 7.6% over the last four weeks ending 3 December, an acceleration from the 5.3% rise recorded last month. However, this is largely the result of double-digit food inflation, with a 4.3% fall in volumes at the grocery multiples as shoppers remained cautious and focused on core essentials ahead of Christmas.

This led to a lift in value growth for categories such as dairy (+13.9%), pet food (+12.5%), frozen food (+11.9%), soft drinks (+10%) and packaged grocery (+9.2%).

Meanwhile, volume sales grew for crisps and snacks (+3.6%), boosted by World Cup gatherings. It was also the second-strongest performing category in terms of value sales (+12.7%).

Beer, wines and spirits, which is a key category to drive value sales at this time of the year, saw both value (-1.5%) and volume (-3.6%) declines. NielsenIQ suggested this was due to overlaps in terms of trade challenges and Covid disruption last year that boosted home drinking. That said, the World Cup helped beer sales grow 3.1% versus a year ago, which led to an additional 1% share of total BWS sales.

A recent Christmas survey from NielsenIQ found that the key factors for consumers when choosing their supermarket this year will be low prices (55%), quality (50%) and good stock availability (49%). Promotions will also have their role to play this Christmas with 43% of consumers saying that promotions are important. While retailers have now launched their Christmas advertising campaigns, NielsenIQ noted that retailers are now reacting to cautious shopper needs by reducing prices across categories including fresh produce, while some are also re-introducing short-term vouchering.

Meanwhile, the data reveals that online sales fell 1.3% and the online share of FMCG spend remained at 11.3%, down from 12.3% this time last year. In contrast, there was strong growth in bricks & mortar stores, with sales up 9.3% and visits growing 7.4% as shoppers hunted for the best-value products.

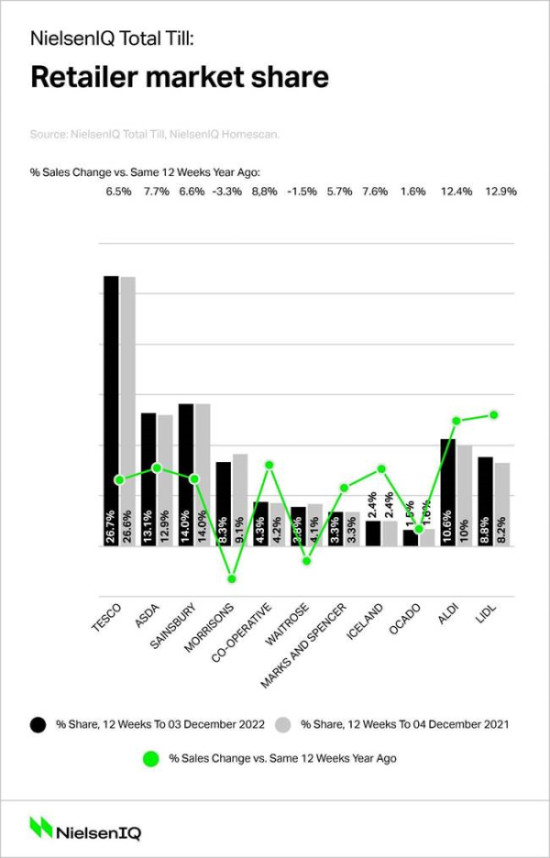

In terms of retailer performance over the last 12 weeks, the discounters continued to gain momentum, with Lidl’s sales up 12.9% and Aldi’s increasing 12.4%. The Co-op (+8.8%) benefited from consumers managing budgets by shopping locally. Meanwhile, sales were strong at Iceland (+7.6%), likely helped by consumers purchasing more frozen food to save money.

“With double-digit food inflation, shoppers will be spending more to buy less this Christmas but there are now a number of new coping strategies to help meet increased costs,” said Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight.

“These include wasting less food, shopping little and more often as well as taking advantage of the many savings being offered by retailer loyalty schemes. However, it is what shoppers are putting into their baskets that is the most revealing. By trading down, for instance to private label, lower priced items or buying different pack sizes, a third of the increased price of the typical shopping basket for the savvy shopper can be saved.”

Watkins added: “With the weather turning colder and seasonal spend increasing every week, if the current momentum is maintained, the sales at the grocery multiples will be the highest yet – around £12.6bn in the next four weeks, with the spend during Christmas week ending 24 December topping £4bn for the first time. Even so, volume sales will fall by around 4% at the supermarkets this Christmas with discounters expected to exceed 19% market share for the first time.”

NAM Implications:

- Patently reduced demand this Christmas for all the usual reasons…

- …where key factors in choosing their supermarket will be:

- low prices (55%)

- quality (50%)

- good stock availability (49%)

- Given those entry-level criteria…

- …supermarkets will have to ‘buy share’ via promos.

- Meanwhile, Aldi & Lidl flourish…