Data released by NielsenIQ (NIQ) shows Total Till sales growth increased by 3.8% in the leading UK supermarkets over the four weeks ending 14th June, up from the 3% hike recorded in May.

With cash-strapped shoppers hunting for the best prices and promotions, in-store visits grew 4.5%, well ahead of online (+1.5%). However, the average spend per visit fell 2.5% to £18.61 – a trend seen throughout 2025 as shoppers continue to seek savings.

NIQ suggested that the uplift in sales was due to warmer weather facilitating al fresco and at-home dining, as well as Father’s Day. However, unit volumes were down 0.7% amid waning consumer confidence and pressure on household budgets from continuing inflation.

Despite this, the NIQ data shows a shift in shoppers’ diets towards healthier options. The largest category shifts over the last month were big pot yogurts (+29%), followed by frozen fruit (+21%), vitamins (+15%), and healthier snacks such as rice cakes (+18%) and sushi (+15%).

A survey by NIQ suggests household health is a paramount concern, with nearly nine out of ten households stating that looking after their health was important or very important, with this mindset channelling consumer spending toward healthier, fresher options. A closer look at healthy eating habits revealed that limiting processed foods is now the single most important aspect for many. 44% of consumers are actively working to reduce their intake of processed items. In addition, 36% are making a concerted effort to eat five portions of fruits and vegetables each day.

Mike Watkins, Head of Retailer and Business Insight at NIQ, commented: “In the first six weeks of summer 2025, shoppers have spent £700m more and 75% (£521m) of that has been in fresh and chilled foods. This perhaps indicates the shift of spend not just towards convenient fresh food options but towards a more healthy and nutritious diet.”

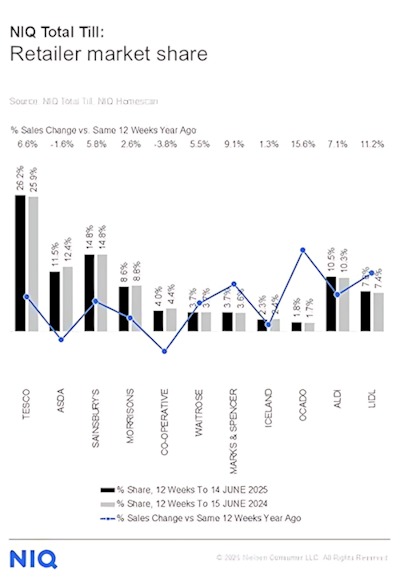

In terms of retailer performance over the past 12 weeks, both Tesco (+6.6%) and Sainsbury’s (+5.8%) benefited from new shoppers and more frequent visits. Ocado continues to be the fastest growing retailer (+15.6%), and Waitrose (+5.5%) also saw good sales momentum.

Meanwhile, Marks & Spencer’s food business saw sales growth slow to 9.1%, reflecting the disruption that followed a cyber attack in April. The retailer had seen growth of 10.8% in last month’s report and 14.7% in the one before that.

Watkins concluded: “A sustained period of summer weather through to the first week of September would be helpful to the industry as this would tip the balance back to positive unit growth.”

NAM Implications:

- ‘in-store visits growth of 4.5%’ appears to indicate consumers’ willingness to shop around.

- Inflation is continuing to drive the search for value.

- Given global, regional and local uncertainties.

- Resulting health concerns are driving trends towards healthier shopping/eating.

- Meanwhile, uncertainty rules…