Despite the cost of living crisis, the warmer and sunnier weather appears to have boosted demand in supermarkets, with Marks & Spencer the fastest-growing retailer outside of the discounters.

Data released by NIQ (previously NielsenIQ) shows volumes in the grocery multiples over the month to 17 June continued to improve, declining only 2% compared to a 2.6% fall in May.

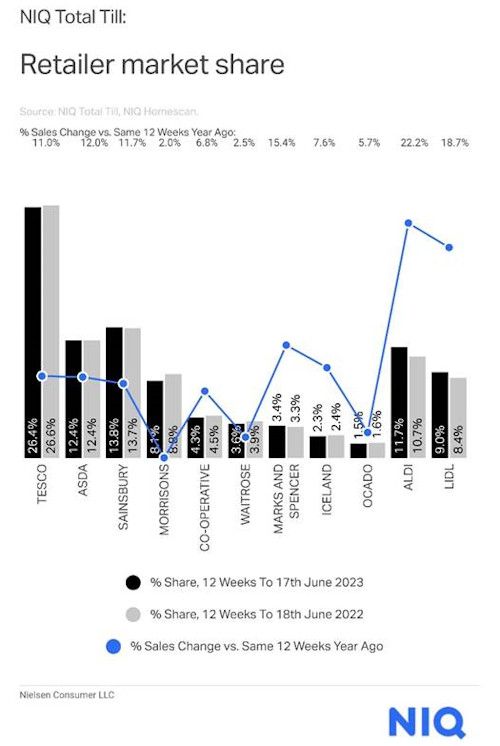

Driven by inflation, total till grocery sales grew 12.4%, a slight increase on the 12.3% rise the previous month.

As would be expected, the warm weather boosted sales of seasonal drink items. There were strong value sales uplifts for sports & energy drinks (+31%), flavoured non-carbs (+23%), mineral water (+25%), and cider (+22%). Other items that benefitted included suncare (+74%), ice-cream (+47%, and hayfever remedies (+25%).

The warm weather also encouraged people to shop in-store, with NIQ’s data showing a rise in in-store sales of 13.4% over the four-week period. As a result, bricks & mortar grocery stores saw spend increase by £1.1bn, compared to the same period last year. This included a significant boost for the convenience channel – where sales grew 11.3% compared to an 8.7% rise in supermarkets. However, this led to slower sales growth (+4.1%) in the online channel, with its share of FMCG sales dipping to 10.4%.

Meanwhile, over the longer 12-week period 17 June, the discounters maintained their strong growth, with sales at Aldi surging 22.2% and Lidl up 18.7%.

Marks & Spencer continued to attract new shoppers, and this led to an increase in sales of 15.4%, maintaining its spot as the fastest-growing retailer after the discounters.

The extension of its new Nectar prices initiative boosted sales growth at Sainsbury’s to 11.7%, with a gain in market share to 13.8%.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commented: “In the last four weeks, there were 34 million extra visits to stores compared to last year and encouragingly 30% more than the additional visits we recorded in early May. These visits would have included smaller baskets, drinks, snacks and refreshments, as shoppers were out and about enjoying the sun. It’s no surprise that online grocery sales have taken a bit of a hit as there was less of a need to order in a big grocery shop.

“We expect to see supermarket volumes continue to improve slowly as food inflation peaks. However, what shoppers buy and where they shop will continue to be strongly influenced by the continued squeeze on disposable incomes. This means that spending over the next few months is still going to be focussed on essential needs, but as we continue to enjoy the sunshine this summer, there’ll be an increase in impulse spending on cold drinks and treats which is an upside for supermarkets in general.”

NAM Implications:

- Apart from a sun-categories bonus, consumers continue to be cautious re spending.

- Therefore mults will try to gain share via lower-priced essentials.

- While Aldi & Lidl continue their enviable growth of 22.2% and 18.7%, respectively…